- Info

Frequently Asked Questions

Migration Regularization and Labor Rights

-

1. How to regularize your immigration status to work formally in Brazil?

*Information prepared in conjunction with the Federal Police and the General Coordination of Labor Immigration of the Ministry of Justice and Public Security.

As a rule, to enter Brazil, it is necessary to present a travel document and a valid visa, unless there is an exemption from an entry visa due to nationality.

The types of visas provided for by Law No. 13,445/2017 (Migration Law) are: visit, temporary, diplomatic, official and courtesy.

The visitor visa applies to short-term trips, and may be waived by Brazil for some nationalities, unilaterally or by agreement with other countries.

The temporary visa is intended for people who have already presented the documentation for qualification in their country of origin.

The following types of temporary visa authorize paid work in Brazil:

1) Temporary visa for work;

2) Temporary visa for humanitarian reception;

3) Temporary visa for family reunion;

4) Temporary visa for research, teaching or extension;

5) Temporary visa for artistic or sports activities;

6) Temporary visa for study;

7) Temporary visa for working holidays, depending on specific conditions;

8) Diplomatic, official and courtesy visas, depending on specific conditions.

A border resident, that is, someone who lives in a municipality bordering Brazil, may request a special authorization from the Federal Police, which will allow them to work and perform other civil acts in Brazil. However, this authorization is restricted to the border municipality and is not valid for the rest of the country. The authorization also does not grant the right to reside in Brazil.

The following types of visa do not authorize paid work in Brazil:

9) Visitor visa (in any of its forms);

10) Temporary visa for health treatment;

11) Temporary visa for voluntary service.

The following types of visa authorize the practice of specific activities in Brazil:

12) Temporary visa for religious activities;

13) Temporary visa for making investments;

14) Temporary visa for carrying out activities with economic, social, scientific, technological or cultural relevance.

Visas are issued by the Brazilian Consular Office in the country where the applicant is located and allow a stay in Brazil for up to 90 days.

For some types of temporary visa, the interested party must apply to the General Coordination of Labor Immigration of the Ministry of Justice and Public Security, through the Migranteweb system (https://migrante.mj.gov.br/login), for a prior residence permit.

After the General Coordination of Labor Immigration has analyzed the qualification documentation, the Consular Office may issue the visa. This procedure applies to the following cases: visa for work; research, teaching or extension; artistic or sports activities; investment in Brazil; carrying out an activity with economic, social, scientific, technological or cultural relevance; practicing religious activities; and volunteer work. Upon arriving in Brazil, anyone in possession of a temporary visa must apply for registration with the Federal Police within 90 days. In this case, the temporary visa will be converted to a residence permit. It is possible for the holder of a visitor or courtesy visa to receive a residence permit during their stay in Brazil, if the necessary requirements are met. To do this, try to find out in advance, as some documents from the country of origin may be requested.

In addition to these cases, authorization for residence in national territory may be granted to a person:

1) who is a beneficiary of a treaty on residence and free movement, as in the case of MERCOSUR and CPLP nationals;

2) who has received a job offer;

3) who has previously held Brazilian nationality and does not wish to or does not meet the requirements to reacquire it;

4) who is a beneficiary of refuge, asylum or stateless person protection;

5) who is an unaccompanied minor or abandoned at Brazilian borders or in national territory;

6) who has been a victim of human trafficking, slave labor or violation of rights aggravated by their condition migratory;

7)who is on provisional release or serving a sentence in Brazil.

A residence permit may be requested even if the person's migratory status is irregular. In all cases, after regularizing your immigration status, the person will be able to work formally in Brazil, in accordance with labor law.

More information can be obtained at: https://www.gov.br/pf/pt-br/assuntos/imigracao -

2. What are the most important Brazilian documents for migrant or refugee workers?

National Migration Registration Card – RNM:

The National Migration Registration Card – RNM is issued by the Federal Police after the registration of the temporary visa, residence permit and authorization to perform acts of civil life (in the case of border residents). The temporary visa authorizes the immediate start of the work for which the employee was hired. However, registration with the Federal Police must be requested within 90 days from the date of entry into Brazil, or 30 days, in the case of domestic employees registered with E-social. In the case of a residence permit, the deadline for requesting registration is 30 days from the date the application is approved.

Individual Taxpayer Registration – CPF:

The Individual Taxpayer Registry (CPF) is carried out by the Brazilian Federal Revenue Service and can be requested by any individual, Brazilian or foreign, residing in Brazil or abroad. For foreigners residing abroad, the service is provided by the Brazilian Consular Office. For foreigners residing in Brazil, the service can be performed online or at partner entities (Correios, Banco do Brasil, Caixa).

Digital Work Card – Digital CTPS:

The Digital Work Card – Digital CTPS is issued by the Ministry of Labor and Employment in digital format, through a mobile application (Android or iOS). Access depends only on the CPF number and the creation of a gov.br account. The digital CTPS is not a prerequisite for registering the employment contract in E-social and can be accessed by the worker at any time, before or after registration. -

3. How to work formally in Brazil?

For a migrant or refugee to work formally in Brazil, the following are necessary:

• a valid visa or residence permit that allows work in Brazil;

• registration with the CPF.

Brazilian legislation does not require intermediaries to hire migrant and refugee workers. Services eventually offered by specialized companies or recruitment agencies are optional and their use is at the discretion of each worker. -

4. What are the types of employment contracts in Brazil?

According to Brazilian legislation, the following types of contracts can be formalized in e-Social:

• Indefinite-term employment contract;

• Trial contract;

• Fixed-term employment contract;

• Intermittent employment contract;

• Domestic employment contract;

• Temporary employment contract;

• Professional apprenticeship contract;

• Internship.

For rural workers, the following contracts can also be signed:

• Harvest contract;

• Short-term rural contract.

With the exception of internships, the other types of employment contracts are used when there is an employment relationship.

According to the law, the employment relationship has the following requirements:

• Personal nature: the worker himself must provide the services as agreed and cannot be replaced on his own.

• Non-eventuality: the provision of services must be continuous and habitual.

• Onerous nature: the work is performed in exchange for payment.

• Subordination: the worker is subject to the employer's power of direction, that is, he must comply with his orders regarding the organization of the work (schedules, procedures, product quality, etc.).

• Alterity: the employer assumes the risks of the economic activity exclusively, that is, he must make the necessary investments and bear any losses, without passing them on to the worker.

-

5. What are the characteristics of each type of formal contract?

-

Indefinite-term employment contract

The indefinite-term employment contract is used for permanent and continuous activities. It is the standard and most complete employment contract provided for by labor legislation. It does not have an estimated date or period for completion and remains valid until one of the parties decides to terminate it.

-

Trial contract

A trial contract is a type of fixed-term contract that applies to the first few months of work, so that the employee and the employer can do a test before signing an employment contract for an indefinite period. The trial contract can be extended once, but its maximum total duration is 90 (ninety) days.

At the end of the stipulated period, the trial contract can be converted into an indefinite-term contract or it can be terminated. In the event of termination, the remaining salary, vacation pay and proportional 13th salary will be due – the advance notice and the 40% fine on FGTS deposits are not due. If the contract is terminated before the scheduled deadline, compensation corresponding to half of the remaining salary until the end date is due, in addition to the advance notice and the 40% fine on FGTS deposits (if the employee was dismissed without just cause). The termination of the contract must be formalized by the Employment Contract Termination Agreement and the payment of severance pay must be made within 10 calendar days. -

Fixed-term employment contract

A fixed-term employment contract applies to temporary activities, which have a fixed end date. An extension is permitted, but the maximum total term of the contract is 2 (two) years. After termination, a new fixed-term contract with the same employee must have a minimum interval of 6 months.

At the end of the contract, the remaining salary, vacation pay and proportional 13th salary will be due – the advance notice and the 40% fine on FGTS deposits will not be due. However, if the contract is terminated before the scheduled term, compensation corresponding to half of the salaries that should have been paid up to the date initially agreed upon is due, in addition to the advance notice and the 40% fine on FGTS deposits (if the employee was dismissed without just cause). The termination of the contract must be formalized by the Employment Contract Termination Agreement and the payment of the termination benefits must be made within 10 calendar days. -

Intermittent employment contract

The intermittent employment contract applies to any type of activity, as long as the provision of services is not continuous, but rather interspersed throughout the year. In the periods in which the employee does not provide services to the employer, no remuneration is due.

The contract must be in writing and must include the hourly rate.

The employer must issue the call for work by any effective means of communication (telephone, text message, audio, etc.) at least 3 days in advance.

After receiving the communication, the employee has 1 (one) business day to say whether or not he or she accepts the call for work. If he or she does not respond, it is considered that he or she has refused the call. The employee cannot be punished in the event of refusal and does not need to justify his or her reason.

Once the call for work has been accepted, the employer and employee must comply with the agreement. Otherwise, whoever is responsible for canceling the appointment must pay, within 30 (thirty) days, compensation of 50% of the value of the services that would be provided. Within the same period, the parties may compensate for services that were no longer provided.

The salary of an intermittent worker may be higher than that of workers who have other types of contracts with the same employer. If the period of service provision exceeds one month, the salary must be paid by the 5th (fifth) business day of the following month.

The monthly salary, the 13th salary, additional payments, vacations increased by 1/3 and weekly paid rest must be paid proportionally at the end of each period of service provision, upon receipt of payment.

The intermittent employment contract is a type of contract for an indefinite period. Upon termination, only the advance notice compensation will be due, calculated based on the average of the amounts received by the employee throughout the contract. In other words, all amounts received by the worker from the date of hiring until the termination must be added together and divided by the number of months worked (art. 37 of Ordinance MTP No. 671/2021). -

Domestic employment contract

See our booklet on the subject.

-

Temporary employment contract

See our booklet on the subject.

-

Professional apprenticeship contract

The professional apprenticeship contract is a type of special employment contract, in which the worker is hired as an apprentice in a certain profession. Thus, in addition to practical activities in the company, the apprentice is also enrolled in a training entity, where he/she will participate in theoretical activities.

The professional apprenticeship contract is intended for adolescents, from fourteen years of age, young people, up to twenty-four years of age, and people with disabilities, with no age limit. If the apprentice has not completed high school, he or she must attend regular school.

As it is an employment contract, the apprentice has labor and social security rights, such as salary, vacation, thirteenth salary, FGTS (2% rate on remuneration) and INSS contributions.

It is a fixed-term contract and its maximum duration is two years. At the end of the contract, apprentices who successfully complete the apprenticeship course will receive a professional qualification certificate.

The contract is terminated at the end of the agreed term, with payment of the due severance pay. However, it is not possible to dismiss the apprentice without just cause before the end of the contract, as the apprentice has a provisional job guarantee. Early termination may only occur in the following cases:

1) automatically when the apprentice turns twenty-four, except for people with disabilities;

1) at the request of the apprentice;

2) insufficient performance or maladjustment of the apprentice, proven by a report from the training entity;

3) serious disciplinary infraction;

4) unjustified absence from school that implies loss of the school year;

5) closure of the establishment, when there is no possibility of transferring the apprentice;

6) death of the employer established as an individual company; and

7) indirect termination. -

Internship

An internship is a supervised educational act carried out in the workplace, which aims to prepare for productive work. It may be mandatory, when it is a legal requirement for obtaining a diploma, or not mandatory.

Internship requirements are: attendance at regular school; a commitment agreement signed between the educational institution and the party granting the internship; compatibility between the activities provided for in the commitment agreement and those carried out by the intern.

The granting party must take out personal accident insurance for the interns, which may be covered by the educational institution in the case of mandatory internships.

The working hours will be a maximum of 4 hours per day and 20 hours per week or 6 hours per day and 30 hours per week, depending on the type of course taken. Internships for courses that alternate theory and practice, during periods when in-person classes are not scheduled, may have a working day of up to 40 (forty) hours per week, provided that this is provided for in the pedagogical project of the course and the educational institution.

The internship will last a maximum of 2 years. This period may be extended if the intern is a person with a disability.

In the case of non-mandatory internships, a stipend and transportation allowance must be paid. These benefits are optional in the case of mandatory internships.

The intern will have a 30-day recess period, preferably during academic vacations, when the internship lasts 1 year or more. If the duration is shorter, the recess period will be calculated proportionally. For interns who receive a scholarship, the recess will be paid.

Internships provided in accordance with the rules do not generate an employment relationship, despite being registered in e-Social.

Foreign students enrolled in higher education courses authorized in Brazil may be hired as interns within the period established in the temporary student visa. -

Harvest contract

A harvest contract is a type of fixed-term contract that applies to agricultural activities, from soil preparation to harvest.

An extension is permitted, but the maximum total term of the contract is 02 (two) years. After termination, a new fixed-term contract with the same employee must have a minimum interval of 6 months.

At the end of the contract, the remaining salary, vacation pay and proportional 13th salary will be due – the advance notice and the 40% fine on FGTS deposits will not be due. However, if the contract is terminated before the scheduled term, compensation corresponding to half of the salaries that should have been paid up to the date initially agreed upon is due, in addition to the advance notice and the 40% fine on FGTS deposits (if the employee was dismissed without just cause). The termination of the contract must be formalized by the Employment Contract Termination Agreement and the payment of severance pay must be made within 10 calendar days. -

Short-term rural contract

The short-term rural contract applies to the rural producer who is an individual for a maximum of 02 (two) months per year. The worker hired for a short term has the same rights as any other rural worker. The salary must be equivalent to that of a permanent rural worker. The monthly salary, the 13th salary, additional payments and vacations plus 1/3 must be calculated daily and paid directly to the worker upon receipt of payment. The termination of the contract must be formalized by the Employment Contract Termination Agreement and the payment of the termination amounts must be made within 10 calendar days.

-

Indefinite-term employment contract

-

6. What are my rights as a worker in an employment relationship?

-

Equal rights with Brazilian workers

The Migration Law (Law No. 13,445/2017) gives migrant workers and refugees the same rights that are guaranteed to Brazilian workers, such as:

• access to public health and social assistance services and social security;

• broad access to justice and free full legal assistance for those who demonstrate insufficient resources;

• guarantee of compliance with legal and contractual labor obligations and application of worker protection standards.

In no case may there be discrimination based on nationality or immigration status. -

Registration on E-social

Registration on E-social depends only on the worker's CPF and information about the period of residence and the condition of entry into Brazil.

To complete the registration, it is not necessary for the worker to have previously accessed their Digital Work Card. The application can be downloaded at any time, before or after registration. For more information about the Digital Work Card, see our booklet.

Registration is the act by which the employer recognizes the existence of an employment relationship and all other rights associated with the employment contract.

Even if registration is not carried out, if the worker carries out his activities informally, with all the requirements of the employment relationship, he will have all the rights guaranteed by law, even if he is in an irregular migratory situation in Brazil. To do this, however, you will have to prove to the Labor Court the existence of these requirements during the period in which you worked for the employer. Irregularities can also be reported to the Labor Inspection (at the Superintendencies, Managements or Regional Labor and Employment Agencies), the Public Ministry of Labor and the Federal Public Defender's Office. -

Receive salary in the amount, in the form and within the period established by law

In Brazil, the minimum wage is set by law and adjusted periodically.

Unions can negotiate a higher amount than that set by law for certain categories of workers. Pay attention to the collective agreements and conventions of your category.

If necessary, the minimum wage value can be converted into smaller units, such as day and hour. For 44-hour workweeks, the value should be divided by 220; for 36-hour workweeks, the divisor will be 180 to find the minimum amount per hour worked.

Housing and food can be provided as utility wages, at maximum percentages of 25% and 20% of the contractual salary. For rural workers, the maximum percentages are 20% for housing and 25% for food.

A portion of the salary may be paid in products (“in natura”), considering fair and reasonable prices, however, the portion paid in cash cannot be less than 30% of the minimum wage. In the case of agricultural work, these products must be obtained from the activity performed and cannot exceed one third of the worker's total salary. Payment of the salary with alcoholic beverages or harmful drugs is not permitted.

When the employer maintains a warehouse for the sale of products, he is prohibited from forcing the workers to buy from that location – the employer cannot interfere with the worker's freedom to spend his salary. This irregularity is present in several situations of work analogous to slavery.

The maximum term for payment of the salary is monthly and must be made by the 5th business day of the month following the month worked (Saturday is also considered a business day for this purpose). Salary advances are not mandatory, but may be provided by the employer voluntarily or if provided for in a collective bargaining agreement or convention. Commission payment is only due after the transaction that gives rise to it has been carried out.

The employee's salary may consist of a fixed amount plus commission or commission only. However, in no case may the final salary be less than the minimum wage provided for by law or in a collective bargaining agreement or convention. An employee who is paid only by commission is entitled to the value of paid weekly rest and overtime (only the additional amount).

The employee's remuneration consists of salary and tips, both those offered directly by customers and those charged by the employer as a service fee or additional amount on the account for distribution among employees.

In intermittent employment contracts and short-term rural contracts, the salary may be paid proportionally immediately after the services are performed, if the period worked is less than 1 month.

Wages may be paid in cash, in Brazilian currency, on a business day and at the workplace, during working hours or immediately after closing. Wages may also be paid by bank deposit. The wages must be detailed on the pay slip and payment will be proven by the employee's signature or fingerprint (if illiterate) on the copy kept by the employer, or by the bank deposit slip. Payment by check is only permitted if the check is issued by the employer and if the employee can go to the bank during business hours to cash the check within the legal deadline.

If the function performed is the same and if the work was performed with the same level of productivity and technical perfection, the workers' wages must be the same. Attention: to ensure equal pay, both parties must work for the same employer at the same time and there must be no difference of more than 4 years in total service time, nor more than 2 years in the same position.

It is prohibited to pay different salaries because of sex, color, origin, ethnicity, religion, age and national origin. In addition to being a labor irregularity, this conduct may give rise to the right to payment of moral damages and constitute a crime, according to Law 7.716/1989. -

Receive the 13th (thirteenth) salary in full or proportionally

The 13th salary is an annual installment that corresponds to the value of the worker's monthly salary. .

It must be paid in full, if the work was carried out during all months of the year, or proportionally, for each month with 15 or more days worked..

Payment may be made in one installment, until November 30th of each year. If it is made in two installments, the first must be paid by November 30th of each year and the second, by December 20th of each year. .

Discounts related to the total value of the 13th salary will only be made in the second installment..

In intermittent employment contracts and short-term rural contracts, the 13th salary will be paid proportionally immediately after the services are performed..

The 13th salary must be detailed on the payment receipt. -

Receive night, dangerous and unhealthy work bonuses

Depending on the working conditions, night shift, hazardous work and unhealthy work allowances must be paid. Urban work performed between 10 pm and 5 am will be paid with an additional 20% in relation to daytime work. Work performed in agriculture between 9 pm and 5 am will be paid with an additional 25% in relation to daytime work.

Work performed in livestock farming between 8 pm and 4 am will be paid with an additional 25% in relation to daytime work.

Dangerous work with electrical energy, explosives, flammable materials, personal or property security with risk of violence or exposure to robbery must be paid with an additional 30%. Other activities may be included in NR-16, which regulates the matter.

Unhealthy work must be compensated with an additional 10%, 20% or 40%, depending on the degree of unhealthiness. The tolerance limits and the physical, chemical and biological unhealthy agents are defined in NR-15.

Some examples of unhealthy activities are: contact with urban waste (40%), contact with patients, animals or infectious-contagious material (20%) and application of some types of pesticides or defensives – DDT, DDD, BHC (20%).

The additional payments must be detailed on the payment receipt. -

Limitation of working hours, timekeeping and payment of overtime

Recording working hours is mandatory in companies with more than 20 employees and can be done manually, mechanically or electronically.

The maximum permitted work day is 8 hours per day and 44 hours per week. The standard monthly work day is 220 hours. Up to 2 hours of overtime per day are permitted, on an occasional basis. In the event of force majeure, a maximum work day of 12 hours is permitted. As a rule, unhealthy activities cannot be extended.

Overtime will be paid at least 50% more than the normal hour. Unions may negotiate a higher percentage than that established by law. Pay attention to collective agreements and conventions for your category.

If authorized in a collective agreement or convention, excess hours on one day may be offset by a corresponding reduction on another day. Overtime hours and their compensation enjoyed in different months are controlled by means of the time bank, and compensation must be made within one year. Compensation may be agreed upon by individual written agreement, but must be made within 6 months.

A 12-hour workday followed by 36 hours of rest may be adopted by individual written agreement or by collective bargaining brokered by the union. The lunch and rest breaks may be used or compensated. The rules on daily workdays apply to all types of employment contracts.

Payment for overtime must be detailed on the pay slip.

Brazilian legislation has some cases with specific workdays. For example:

Activity Special Hours Work in underground mines 6 hours a day and 36 hours a week. Refrigeration service with exposure to cold or temperature changes 20-minute break after every 1 hour and 40 minutes of work. Work in Telemarketing/Teleservice 6 hours a day and 36 hours a week, with two 10-minute breaks each, away from the workstation. Elevator operator, elevator operator 6 hours a day. Drivers Extension of up to 2 extra hours, 1-hour lunch break, 11-hour rest between shifts and 35-hour weekly rest. For trips longer than 24 hours, breaks of at least 30 minutes are authorized for every 4 hours of driving. Some items may be defined by collective bargaining. Oil Workers 8-hour rotating shifts, with a 24-hour rest after every three shifts worked. For some activities, the shift may be 12 hours long, with a 24-hour break after each shift worked. Community health agent 40 hours per week, determined according to the region's climate conditions. Artists and Technicians in Shows Radio broadcasting: 6 hours per day and 30 hours per week.

Cinema (in studio): 6 hours per day.

Circus and variety shows: 6 hours per day and 36 hours per week.

Dubbing: 6 hours per day and 40 hours per week.

Theater (rehearsal): 8 hours per day.

Theater (performance): 8 sessions per week.

The workday will be divided into two shifts, each lasting a maximum of 4 hours. Breaks may be longer than 2 hours to improve artistic performance.Radiology technicians 24 hours per week.

In the case of workers who are breastfeeding, information can be found in our booklet. -

Breaks and days off

The worker has the right to:

1) paid weekly rest of at least 24 consecutive hours, which must coincide with Sunday at least once every 7 weeks and, in the case of women, every fortnight.

2) a break between work shifts of at least 11 consecutive hours, even if the worker worked overtime the previous day;

3) a 15-minute lunch and rest break, if the daily work shift is 6 hours; if it is 8 hours, the break must be between 1 and 2 hours, and this break may be the subject of negotiation in a collective bargaining agreement or convention.

-

Vacation

After working for 12 months (acquisition period), the employee is entitled to 30 days of vacation, which must be taken in the next 12 months (concession period).

Attention: the employer is the one who defines the vacation schedule and the employee must be notified in writing, 30 days in advance. Family members who work for the same employer will be entitled to take vacations in the same period, if it does not result in harm to the service. An employee under 18 years of age who is a student has the right to coincide his vacation from work with his school vacation.

If the employee agrees, the vacation can be divided into up to 3 periods, one of which must be at least 14 consecutive days and the other two, at least 5 consecutive days each.

It is forbidden to start vacations in the 2-day period preceding a holiday or paid weekly rest.

It is forbidden to discount the employee's absences during the vacation period. Discounts may be made as provided for in the CLT:

Number of Absences Vacation Days Up to 5 30 consecutive days. Between 6 and 14 24 consecutive days Between 15 and 23 18 consecutive days Between 24 and 32 12 consecutive days

Vacations may be granted collectively in up to 2 annual periods of at least 10 consecutive days each. For workers who have worked for less than 12 months, collective vacations will be granted proportionally and a new acquisition period will begin.

Vacations must be paid at the monthly rate plus 1/3. Payment must be made to the worker up to 2 days before the start of the vacation, upon receipt of vacation pay. If the 12-month period for granting vacations is not observed, double the remuneration must be paid.

Workers have the right to “sell” 1/3 of their vacations (10 days), as long as they notify the employer up to 15 days before the end of the acquisition period. This is called pecuniary allowance.

In intermittent employment contracts and short-term rural contracts, vacations will be paid proportionally immediately after the services are performed. -

FGTS Collections

As a rule, workers are entitled to FGTS collection totaling 8% of their monthly salary. For young apprentices, this total is 2%. In the event of dismissal without just cause, a fine of 40% will be due on all monthly deposits due to the worker.

Payment is made by the employer through a payment slip and the amount will be deposited into the worker's linked account with CAIXA, where it will be updated with interest and monetary correction. Unlike what happens with social security contributions, in the case of the FGTS, no deductions are made from the worker's salary.

The worker will have access to the FGTS amount deposited only in certain situations, such as, for example, dismissal without just cause, termination by agreement, termination of a fixed-term contract, termination of an employment contract due to mutual fault or force majeure, total or partial closure of the company, suspension of casual work, death of the individual employer, retirement, death of the worker, worker aged 70 or over, for health reasons of the worker or his/her dependent (HIV, cancer, terminal stage due to serious illness), acquisition of an orthosis or prosthesis for accessibility and social inclusion, real estate financing and in the event of a natural disaster that has hit the worker's residence and has been officially recognized as an emergency or calamity by the Federal Government. -

Transportation vouchers, meal vouchers, food vouchers and other benefits

Workers are entitled to a transportation voucher in advance, for travel between their home and workplace by public transportation (there does not need to be a minimum distance between the two addresses). The granting of a transportation voucher authorizes a deduction of up to 6% of the worker's base salary. If the employer provides private transportation to workers, they are not required to pay the transportation voucher for the covered journey.

To receive the benefit, the worker must provide, in writing, his/her residential address and the public transportation he/she uses. False statements or improper use of the transportation voucher constitute serious misconduct and may result in dismissal for just cause.

The amount paid as transportation vouchers is not considered salary, is not incorporated into the worker's remuneration and is not the basis for calculating the thirteenth salary, social security contributions, FGTS and other taxes. The decree that regulates transportation vouchers prohibits their payment in cash.

Unlike transportation vouchers, which are mandatory, meal vouchers and food vouchers are optional benefits that the employer may grant to the worker.

Meal vouchers, food vouchers and other benefits may be provided for in collective bargaining agreements or conventions, in which case they become mandatory for the employer.

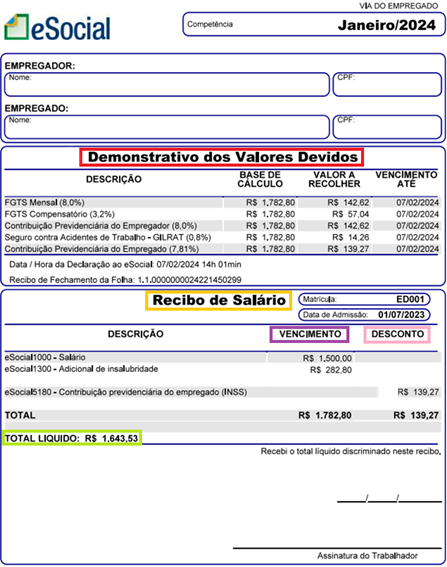

Detailed payment receipt, including permitted discounts

e-Social uses the following payment receipt model:

Understand what each field means:

In this document, the worker finds the INSS and FGTS amounts that must be collected by the employer. These amounts will not be passed on directly to the worker.

It is the document that contains the amounts that will be paid and discounted from the worker.

In this column, all amounts owed to the worker will be detailed (salary, thirteenth salary, overtime, night shift allowance, unhealthiness or dangerousness allowance, if applicable, among others).

In this column, discounts will be detailed. The main examples are:

1. Employee's contribution to the INSS. For the FGTS, there can be no discount on the employee's salary.

2. Income Tax, when the gross salary minus the INSS contribution is higher than the exemption range defined by the Federal Revenue Service.

3. Salary advance granted to the employee (limit of 40% of the salary).

4. Transportation voucher, of a maximum of 6% of the base salary, if the employee has chosen it.

5. Union contributions, if the employee authorizes or does not oppose the collection.

6. Late arrivals and absences.

7. Alimony, if there is a court order.

The employer is prohibited from making any deductions from the salary that are not provided for by law or collective bargaining. If the employee causes any harm to the employer, the deduction will be allowed if there is an agreement between the parties or if the employee acted willfully, that is, with the intention of causing harm.

Amounts related to personal protective equipment, uniforms (if the company requires their use in the workplace), occupational medical exams, among others, cannot be deducted from the employer's salary.

In this field, the worker finds the final value of the salary that he will receive, after the due discounts. -

Changes to the employment contract, absences and leaves permitted by law

The individual employment contract can only be changed with the agreement of both parties and the change cannot cause direct or indirect harm to the employee. Should this occur, the change will be considered null and void.

The employer cannot transfer the employee to a location other than the one agreed upon, which results in a change of domicile, without the employee's consent. The transfer, however, is permitted if the establishment where the activities were carried out is closed.

If the service is necessary and the employee agrees, the transfer may be made and the employer will be responsible for paying all expenses, in addition to an additional 25% of the employee's salary until the employee returns to the original location.

The employee may be absent from work without deduction of salary in the following cases:

1) up to 2 consecutive days, in the event of the death of a spouse or partner, ascendant, descendant, sibling or registered economic dependent;

2) up to 3 consecutive days, for marriage;

3) for 5 consecutive days, from the birth of a child, adoption or shared custody;

4) for 1 day, for every 12 (twelve) months of work, for duly proven voluntary blood donation; 5) up to 2 (two) consecutive days or not, to register as a voter;

6) during the period in which the person must fulfill the requirements of Military Service;

7) on the days in which the person is demonstrably taking entrance exams for higher education; 8) for as long as necessary, when the person must appear in court.

9) for as long as necessary, when, as a representative of a union entity, he/she is participating in an official meeting of an international organization of which Brazil is a member.

10) for the time necessary to accompany his/her wife or partner to up to 6 (six) medical appointments, or to additional exams, during the pregnancy period;

11) for 1 (one) day per year to accompany a child up to 6 (six) years old to a medical appointment.

12) up to 3 (three) days, in every 12 (twelve) months of work, in the case of duly proven preventive cancer exams.

An employee who is retired due to disability will have his/her employment contract suspended. If he/she recovers his/her ability to work, the retirement will be canceled and he/she will be entitled to return to work. If the employee does not have job security, the employer may choose to terminate the contract by paying compensation.

In the case of sickness insurance or sickness benefit, the employee is considered to be on unpaid leave during the term of this benefit.

The employment contract may be suspended for 2 to 5 months for the employee to participate in a professional qualification course or program offered by the employer, with authorization in a collective bargaining agreement or convention, formal agreement by the employee and notification by the union. This may only occur once every 16 months and the employer may pay the employee a monthly compensatory allowance, not of a salary nature. If the employee is dismissed during the contract suspension or in the three months following his/her return to work, a fine of at least 100% of the last salary will be due, in addition to the termination installments. The amounts of the compensatory aid and the fine will be set in collective bargaining.

The suspension of the employee for more than 30 consecutive days constitutes unfair termination of the employment contract. Upon returning to work, the employee will be entitled to all benefits that, in his absence, were attributed to the category. -

Termination of employment contract in accordance with the law

The employment contract may be terminated by:

• Employee's resignation.

• Termination by agreement.

• Dismissal without just cause.

• Dismissal with just cause.

• Indirect termination of the employment contract.

Specific situations regarding the termination of the contract were discussed in the topics relating to each type of contract. Employee's resignation request:

The termination of the contract at the employee's initiative is done through a resignation request.

The employee who resigns is entitled to receive the remaining salary, the proportional thirteenth salary and the accrued and proportional vacations plus one third.

1) Salary balance: the salary balance corresponds to the payment of the days worked in the month in which the resignation request was made.

2) Proportional thirteenth salary: the proportional thirteenth salary is calculated per month worked or fraction equal to or greater than 15 days; the base salary for the calculation must include additional payments, overtime and commissions; If the employer has advanced the thirteenth salary at the employee's request at the time of his/her vacation, the excess amount due to the resignation may be discounted from the severance pay.

3) Vacation: vacation due at the time of termination can be divided into three categories:

3.1) Full vacation: after working for 12 months, the employee acquires the right to 1 month of vacation, which must be taken in the following 12 months. It may be that the resignation request occurred within these following 12 months, without the employee having taken his/her vacation. In this case, it must be paid at the time of termination, plus one third.

3.2) Accrued vacation: after working for 12 months, the employee acquires the right to 1 month of vacation, which must be taken in the following 12 months. If the 12-month period has already ended at the time of the resignation without the employee having taken their vacation, they must be paid double, plus one third.

3.3) Proportional vacation: if the employee does not complete the 12 months necessary to acquire 1 month of vacation, the vacation must be calculated proportionally, referring to the month or fraction equal to or greater than 15 days worked. The amount corresponding to the proportional vacation must also be paid at the time of termination, plus one third.

FGTS and Unemployment Insurance: When resigning, the employee is not entitled to the FGTS termination fine, to the withdrawal of the FGTS and to the receipt of unemployment insurance.

Notice period: if there is no other period established by collective bargaining agreement or convention, when resigning, the employee must give 8 days' notice if he/she receives his/her salary weekly or biweekly, or 30 days' notice if he/she receives his/her salary monthly. If the employee leaves the job before completing the notice period, the employer may deduct the missing period from the severance pay.

A reduction in working hours during the notice period is not due when the resignation is submitted. During the notice period, the employee and employer may decide to maintain the employment contract, without having to make any changes. In this case, it is considered that the notice period was not given. In the event of serious misconduct during the notice period, the employee who committed the misconduct loses the right to the remainder of the period. If the employer commits a serious offense, he/she must pay the entire period and any compensation that is due.

Documents and formalities: it is recommended that the employee submits the resignation request in writing, so that there are no doubts regarding dates, advance notice and other relevant information. The termination of the employment contract must be documented by the Employment Contract Termination Term, with a description of each of the installments due to the employee. The termination of the employment contract does not require approval by the workers' union, even for contracts lasting more than one year. However, in case of doubt, the employee may consult the union.

Payment: the termination payment may be made in cash, bank deposit or certified check. However, if the employee is illiterate, payment by check is prohibited. The maximum period for payment of severance pay to the employee is 10 calendar days, counted from the end of the contract, regardless of the type of notice period (worked or compensated). Any compensation in the payment made by the employer may not exceed the value of one monthly salary of the employee. In case of delay in payment, a fine in the amount of one minimum wage is due to the employee. -

Termination by agreement:

The termination of the employment contract by agreement between the employee and the employer was introduced by the Labor Reform (Law No. 13,467/2017) and applies to all workers, including rural workers.

In the event of termination by agreement, the employee is entitled to receive the remaining salary, the proportional thirteenth salary and the accrued and proportional vacations plus one third.

1) Balance of salary: the remaining salary corresponds to the payment for the days worked in the month in which the resignation was made.

2) Proportional thirteenth salary: the proportional thirteenth salary is calculated per month worked or fraction equal to or greater than 15 days; the base salary for the calculation must include additional payments, overtime and commissions; if the employer has advanced the thirteenth salary at the employee's request at the time of his/her vacation, the excess amount due to the resignation may be discounted from the severance pay.

3) Vacation: vacation due upon termination can be divided into three categories:

3.1) Full vacation: after working for 12 months, the employee acquires the right to 1 month of vacation, which must be taken within the following 12 months. It may be that the resignation request occurred within these following 12 months, without the employee having taken their vacation. In this case, they must be paid at the time of termination, plus one third.

3.2) Accrued vacation: after working for 12 months, the employee acquires the right to 1 month of vacation, which must be taken within the following 12 months. If this period of 12 months has already ended at the time of the resignation request without the employee having taken their vacation, they must be paid double, plus one third. 3.3) Proportional vacation: if the worker does not complete the 12 months necessary to acquire 1 month of vacation, the vacation must be calculated proportionally, referring to the month or fraction equal to or greater than 15 days worked. The amount corresponding to the proportional vacation must also be paid at the time of termination plus one third.

FGTS and Unemployment Insurance: the worker is entitled to half of the FGTS termination fine and may withdraw FGTS up to the limit of 80% of the amount deposited. The worker is not entitled to receive unemployment insurance in the event of an agreement.

Advance notice: if there is no other term established by agreement or collective bargaining agreement, the advance notice will be 30 days and may be worked or compensated. If compensated, the rural worker will be entitled to receive half of the amount corresponding to the period. If the employee leaves the job before completing the notice period, the employer may deduct the missing period from the severance pay.

During the notice period, the employee and employer may decide to maintain the employment contract without any need to make any changes. In this case, it is considered that the notice period was not given. In the event of a serious breach during the notice period, the employee who committed the breach loses the right to the remainder of the period. If the employer is the one who committed the breach, he or she must pay the entire period and any compensation that is due. Documents and formalities: it is recommended that the agreement be formalized in writing, so that there are no doubts regarding dates, notice period and other relevant information. The termination of the employment contract must be documented by the Employment Contract Termination Agreement, with a description of each of the installments due to the employee. The termination of the employment contract by the workers' union is not required to be approved, even for contracts lasting more than one year. However, in case of doubt, the worker may consult the union.

Payment: payment may be made in cash, bank deposit or certified check. However, if the worker is illiterate, payment by check is prohibited. The maximum term for payment of severance pay to the worker is 10 calendar days, counted from the end of the contract, regardless of the type of notice period (worked or compensated). In case of late payment, the worker is required to pay a fine in the amount of one minimum wage. -

Dismissal without just cause:

Dismissal without just cause is a way for the employer to terminate an employment contract and should be adopted when the employee does not commit any serious misconduct at work.

An employee who is dismissed without just cause is entitled to receive the remaining salary, the proportional thirteenth salary and accrued and proportional vacations plus one third, in addition to the FGTS termination fine. He is also entitled to withdraw the FGTS and receive unemployment insurance.

1) Salary balance: the salary balance corresponds to the payment for the days worked in the month in which the resignation was made.

2) Proportional thirteenth salary: the proportional thirteenth salary is calculated per month worked or fraction equal to or greater than 15 days; the base salary for the calculation must include additional payments, overtime and commissions; If the employer has advanced the thirteenth salary at the employee's request at the time of his/her vacation, the excess amount due to the resignation may be discounted from the severance pay.

3) Vacation: vacation due at the time of termination can be divided into three categories:

3.1) Full vacation: after working for 12 months, the employee acquires the right to 1 month of vacation, which must be taken in the following 12 months. It may be that the resignation request occurred within these following 12 months, without the employee having taken his/her vacation. In this case, it must be paid at the time of termination, plus one third.

3.2) Accrued vacation: after working for 12 months, the employee acquires the right to 1 month of vacation, which must be taken in the following 12 months. If the 12-month period has already ended at the time of the resignation request without the employee having taken their vacation, they must be paid double, plus one third.

3.3) Proportional vacation: if the employee does not complete the 12 months necessary to acquire 1 month of vacation, the vacation must be calculated proportionally, referring to the month or fraction equal to or greater than 15 days worked. The amount corresponding to the proportional vacation must also be paid at the time of termination, plus one third.

4) FGTS termination fine: must be deposited in the employee's linked account and will correspond to 40% of all monthly deposits for the period worked.

5) FGTS withdrawal: the rural worker may withdraw the FGTS after registering the termination of the employment contract in E-social, which must be done by the employer. The registered information will appear in the Digital CTPS.

6) Unemployment insurance: rural workers may apply for unemployment insurance after registering the termination of their employment contract in E-social, which must be done by the employer. The registered information will appear in the Digital CTPS.

Advance notice: advance notice may be established by collective bargaining agreement or convention, observing the minimum period of 30 days and the maximum period of 90 days. If there is no collective standard in this regard, Law No. 12,506/2011 applies, as per the table below:

Working time

(full years)Notice period

(days)0 30 days 1 33 days 2 36 days 3 39 days 4 42 days 5 45 days 6 48 days 7 51 days 8 54 days 9 57 days 10 60 days 11 63 days 12 66 days 13 69 days 14 72 days 15 75 days 16 78 days 17 81 days 18 4 days19 87 days 20 90 days

The notice period may be worked or compensated. In the compensated notice period, the employer exempts the employee from reporting to work, but the payment for the period must be made in the same way. If the employee leaves work before completing the notice period, the employer may deduct the missing period from the severance pay.

In the case of dismissal without just cause, the employer must grant one day off per week to the rural worker during the notice period, without deduction from the salary. For urban workers, the reduction may be 2 hours per day or 7 consecutive days, without deduction from the salary.

During the notice period, the employee and employer may decide to maintain the employment contract, without having to make any changes. In this case, it is considered that the notice period was not given. In the event of serious misconduct during the notice period, the employee who committed the misconduct loses the right to the remainder of the period. If the employer is at fault, he/she must pay the entire period and any compensation that is due.

Documents and formalities: it is recommended that the dismissal without just cause be formalized in writing, so that there are no doubts regarding dates, advance notice and other relevant information. The termination of the employment contract must be documented by the Employment Contract Termination Agreement, with a description of each of the installments due to the employee. The termination of the employment contract does not require approval by the workers' union, even for contracts lasting more than one year. However, in case of doubt, the employee may consult the union.

Payment: payment may be made in cash, bank deposit or certified check. However, if the employee is illiterate, payment by check is prohibited. The maximum period for payment of severance pay to the employee is 10 calendar days, counted from the end of the contract, regardless of the type of notice period (worked or compensated). In the event of late payment, the employee is required to pay a fine in the amount of one minimum wage. -

Dismissal with just cause:

Dismissal with just cause is a way for the employer to terminate an employment contract when the employee commits a serious misconduct at work.

In short, just cause is related to the employee's misbehavior and the practice of dishonest acts, acts of indiscipline or insubordination, abandonment of employment, neglect in the performance of services or verbal or physical offenses in the workplace, against the employer or members of his/her family. Also constitute serious misconduct: requesting or improper use of transportation vouchers, habitual drunkenness at work, constant gambling and negotiations made on the employee's own behalf that cause competition with the employer's activity or that harm the service.

A worker dismissed with just cause is entitled to receive the remaining salary and accrued vacation pay:

1) Salary balance: the remaining salary corresponds to the payment for the days worked in the month in which the resignation was made.

2) Vacation: the vacation pay due upon termination with just cause can be divided into two categories:

3.1) Full vacation: after working for 12 months, the worker acquires the right to 1 month of vacation, which must be taken in the following 12 months. It is possible that the resignation was made within these following 12 months, without the worker having taken his vacation. In this case, it must be paid at the time of termination, plus one third.

3.2) Overdue vacation: after working for 12 months, the employee acquires the right to 1 month of vacation, which must be taken in the following 12 months. If this period of 12 months has already ended at the time of the resignation without the employee having taken his vacation, he must be paid double the amount, plus one third.

When dismissed for just cause, a rural worker is not entitled to:

1) Advance notice;

2) Proportional thirteenth salary;

3) Proportional vacation;

4) FGTS termination fine;

5) FGTS withdrawal;

6) Unemployment insurance.

Documents and formalities: it is recommended that the dismissal for just cause be formalized in writing, so that there are no doubts regarding dates and other relevant information. The termination of the employment contract must be documented by the Employment Contract Termination Agreement, with a description of each of the installments due to the worker. The approval of the termination of the employment contract by the workers' union is waived, even for contracts lasting more than one year. However, in case of doubt, the worker may consult the union.

Payment: payment may be made in cash, bank deposit or certified check. However, if the worker is illiterate, payment by check is prohibited. The maximum term for payment of severance pay to the worker is 10 calendar days, counted from the end of the contract, regardless of the type of notice period (worked or compensated). In case of late payment, the worker is required to pay a fine in the amount of one minimum wage. -

Indirect termination of the employment contract:

Indirect termination of an employment contract occurs at the initiative of the employee in the event of serious misconduct by the employer.

In short, the employer commits serious misconduct when he fails to fulfill the obligations of the contract, when he demands from the employee services that are beyond his/her capabilities, prohibited by law, not agreed upon in the employment contract or that are contrary to good customs, when he/she verbally or physically offends the employee or someone in his/her family, or when he/she reduces his/her activities to the point of harming his/her salary.

In order to recognize indirect termination, the employee will need to file a lawsuit in the Labor Court.

If the indirect termination is confirmed by the Labor Court, the employee will have the same rights guaranteed in the event of dismissal without just cause. Payment will be made during the legal action. If the Court concludes that both the employer and the employee were at fault, the amount of compensation due may be reduced by half. -

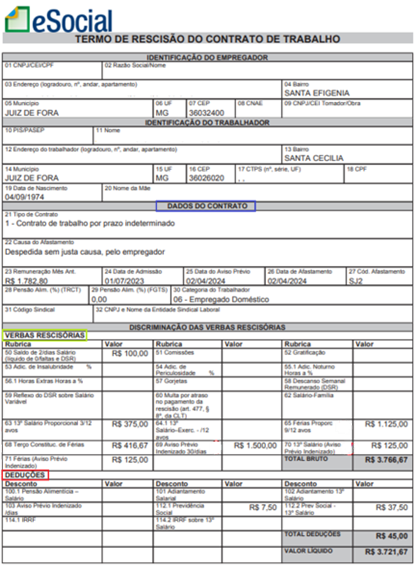

Formalization of Termination of Employment Contract

This is the model of the employment contract termination term used by e-Social:

In this part of the document, the worker will find the contract data work contract. The main ones are:

• Field 21: type of employment contract (e.g. indefinite term, fixed term, seasonal, intermittent, among others).

• Field 22: reason for the absence (e.g. resignation, dismissal without just cause, among others).

• Field 23: amount of remuneration for the previous month.

• Field 24: date of admission to the job.

• Field 25: date of advance notice.

• Field 26: date of absence. In the case of compensated advance notice, the date of the advance notice and the date of absence will be the same.

In this part of the document, the worker will find the value of each of the installments (items) that is due. The main ones are:

• Heading 50: salary balance (salary value for the days worked in the month of absence).

• Headings 53, 54 and 55: additional payments for unhealthy conditions, dangerous conditions and night work.

• Heading 56.1: overtime.

• Heading 63: proportional thirteenth salary.

• Heading 65: proportional vacations.

• Heading 68: payment of one third of the vacation value.

• Heading 69: compensated advance notice.

• Heading 70: thirteenth salary on compensated advance notice.

• Heading 71: vacations on the compensated prior notice.

In this part of the document, the worker will find the value of the installments that can be discounted, as seen on the payment receipt.

Union participation, collective bargaining and the right to strike Unions work to defend the collective and individual rights and interests of the category they represent, including in judicial or administrative matters.

In the exercise of their functions, union entities contribute not only to improving the working and living conditions of their representatives, but also to enforcing rights and guarantees that may have been violated by employers.

Through collective bargaining, collective labor agreements are signed between the workers' union and specific employers, or collective labor agreements between the workers' unions and the employers' union.

Collective agreements and conventions create different rules for each category and can guarantee more benefits for workers, such as minimum wages and salary adjustments, health insurance, food vouchers, daycare assistance, bonuses, insurance, basic food baskets, among others.

Workers have the right to join or leave the union of their category, voluntarily and without suffering reprisals from the employer.

Workers have the right to run for management positions in their union, in accordance with each statute, and cannot be harmed by the employer due to their candidacy. Union leaders are guaranteed job security from the date of registration of their candidacy for the union position until 1 (one) year after the end of their term. This right is guaranteed to a maximum of 7 (seven) union leaders and 7 (seven) substitutes. Workers who apply for the position of union leader must notify their employer in writing about the registration of their candidacy, as well as their election and inauguration in order for the tenure to be valid.

Currently, workers are not required to pay the “union tax” (equivalent to one day of the employee’s work), which was previously deducted once a year. This union contribution has become optional and requires prior and express authorization from the worker to be collected.

However, the social assistance contribution, defined in a collective agreement or convention, although not mandatory, will be deducted automatically if the worker does not object. The form of deduction is defined in collective bargaining.

Workers are guaranteed the right to strike as an instrument of collective struggle, allowing activities to be interrupted, in accordance with the law, as a way of demanding better working conditions, wages, benefits or defending their interests. The employer must be notified of the strike 48 hours in advance. If the activity being stopped is essential, employers and users must be notified 72 hours in advance. In this case, teams of workers will remain active to prevent a complete shutdown of services. Examples of essential activities include: water supply, production and distribution of electricity, gas and fuels, public transportation, garbage collection, medical and hospital care, among others.

Strikers may raise funds and freely publicize the movement, in addition to using peaceful means to convince other workers to join the strike. However, they may not impede access to work or threaten or cause damage to people or property.

During the strike, pay attention to collective agreements or conventions, arbitration awards or decisions of the Labor Court, as these are the rules that will apply to your employment contract. For more information, contact the union in your category, in the Municipality where you provide services, or the highest-level entity in your category (Federation/Confederation).

The list of Trade Union Entities registered with the Ministry of Labor and Employment is available to everyone at: https://www.gov.br/trabalho-e-emprego/pt-br/servicos/sindicatos/cadastro-de-entidades/entidade-sindical-registrada. -

Salary Bonus

The Salary Bonus is an annual benefit worth a maximum of one minimum wage in effect on the date of payment. To be entitled to the benefit, the worker must:

• perform paid work for at least 30 days in the base year;

• receive up to two minimum wages in monthly remuneration;

• provide services to legal entities that pay PIS or PASEP;

• be registered for at least 5 years in the PIS-Pasep Participation Fund or in the National Social Information Registry – CNIS (date of first employment);

• have employment contracts correctly reported by the employer in RAIS or e-Social.

The amount of the benefit varies according to the number of months worked in the base year. The annual payment schedule is defined by the worker's month of birth and payment is made by CAIXA for workers in private companies and by Banco do Brasil for public servants.

More information can be found at: https://www.gov.br/pt-br/servicos/receber-o-abono-salarial. -

Unemployment Insurance

Unemployment Insurance is intended to provide temporary financial assistance to workers with employment contracts who were involuntarily dismissed (without just cause) and who:

• Do not have their own income that is sufficient to support themselves and their families.

• Do not receive any continued social security benefit, with the exception of accident assistance and survivor's pension.

• Prove to have received wages for:

• at least 12 months in the last 18 months immediately prior to the date of dismissal, when the first request is made; or

• at least 9 months in the last 12 months immediately prior to the date of dismissal, when the second request is made; or

• each of the 6 months immediately prior to the date of dismissal, in the case of other requests.

Workers who meet these conditions will be entitled to a number of installments proportional to the time they remained in employment:

• In the first request:

• 4 installments, in the case of 12 to 23 months worked;

• 5 installments, from 24 months worked.

• In the second request:

• 3 installments, in the case of 9 to 11 months worked;

• 4 installments, in the case of 12 to 23 months worked; and

• 5 installments after 24 months worked.

• On the third request:

• 3 installments, in the case of 6 to 11 months worked;

• 4 installments, in the case of 12 to 23 months worked; and

• 5 installments after 24 months worked.

The value of the installments will correspond to a percentage of the worker's previous average salary, according to the salary ranges published annually by the Ministry of Labor and Employment. The value of the installment will be at least one minimum wage.

The application for unemployment insurance can be made online, through the Digital Work Card App (Android or iOS) or through the service networks of the Ministry of Labor and Employment (MTE). To receive service at the Regional Superintendencies of Labor, an appointment must be made in advance by calling 158.

The application must be made between the 7th and 120th day from the date of dismissal without just cause (the first day of the term will be the day after the end of the employment contract).

Instructions for applying and monitoring the process of granting unemployment insurance can be found at: https://www.gov.br/pt-br/servicos/solicitar-o-seguro-desemprego.

Further information can be obtained at: https://www.gov.br/pt-br/temas/duvidas-frequentes-seguro-desemprego#_Toc21529983. -

Ensuring health and safety conditions at work

The employer is responsible for providing a safe and healthy working environment for workers in accordance with the Regulatory Standards (NR) of the Ministry of Labor and Employment. This includes providing:

• drinking water;

• sanitary facilities in good working order and hygiene, separated by sex (when there are workers of both sexes) and in sufficient numbers to meet the number of workers working at the site;

• lockers for personal belongings;

• places to eat;

• adequate accommodation (when available);

• collective protection and personal protective equipment (when collective protection measures are non-existent or insufficient) in good condition, with guidance on their use, maintenance and guarantee of hygiene and replacement when necessary;

• machines and tools necessary to perform the work, with adequate protection;

• a clean, organized workplace with adequate electrical installations;

• buildings with level floors and resistant walls and roofs;

• carrying out occupational medical examinations;

• risk control occupational (physical, chemical, biological, ergonomic, psychosocial, accidents);

• comprehensible guidelines on workplace safety procedures;

• training and qualification of the worker to perform his/her functions.

-

Equal rights with Brazilian workers

-

7. What are my duties as an employee in an employment relationship?

• Act ethically and honestly.

• Behave appropriately in the workplace.

• Do not engage in routine business dealings in the workplace without the employer's permission.

• Do not physically or verbally abuse the employer, co-workers, customers, and other people in the company.

• Do not gamble or show up to work drunk.

• Do not engage in acts of indiscipline or insubordination.

• Preserve confidential business information.

• Maintain the productivity and quality of your work.

• Make legal communications to the employer within the correct time frame to exercise your duties and rights.

• Comply with the rules on safety and health at work.

• Comply with the service orders issued by the employer.

• Undergo the medical examinations that the rules determine.

• Use and maintain the personal protective equipment provided by the employer.