Elaborating Declaration Of Outbound Valuables

To elaborate a Declaration of Outbound Valuables, one should choose the option “Departing from Brazil” on the Initial Menu, as shown in Figure 33

Figure 33

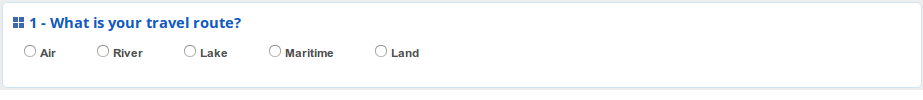

Once the option is chosen, a series of questions will be presented. You should indicate the transportation modality used to enter the country, the traveler’s data and the amount of cash carried. The tab “Baggage Information” will then be made available.

“Baggage information” Tab – Answering the questions

1) Question: What transportation modality was used?

- Air:

- River:

- Lake:

- Maritime:

- Land:

After choosing the option, the first question will be presented. The traveler should indicate the transportation modality to be used to leave the country, as shown in Figure 34.

Figure 34

On selecting one of the options, the next question will be presented.

2) Question: Are you carrying or transporting cash in your baggage in an amount greater than the equivalent of US$ 10,000.00? (Figure 35)

- Yes: in this case, following the procedure detailed in item 3 under “Elaborating a Declaration of Outbound Valuables”, you should specify what items from this category you are bringing into the country. Here, one should indicate the amounts carried in each currency, which will then be automatically converted into Real.

- No

Figure 35

After this, click “Advance” in order to inform the data from tab “Traveler and Travel Data”.

“Traveler and Travel Data” Tab

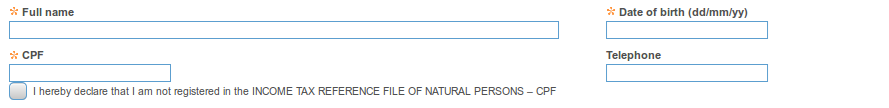

The following spaces should be completed under this tab (Figures 36, 37 and 38):

Figure 36

|

Space |

Valuables |

|

Complete name |

Complete name of the traveler |

|

Date of birth |

Date of birth of the traveler |

|

CPF |

Registration in the Income Tax Reference File of Natural Persons |

|

I hereby declare that I am not registered in the Income Tax Reference File of Natural Persons – CPF |

This space should be marked, if the traveler does not have a CPF number. |

|

Phone |

Number for purposes of contact, including the country code and area code |

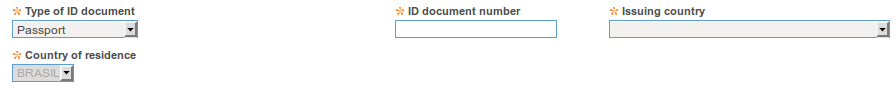

Figure 37

|

Space |

Amounts |

|

Type of identification document |

Type of document to be presented for identification purposes |

|

Identification document |

Number of identification document |

|

Issuer country |

Country that issued the identification document |

|

Country of residence |

Country in which the traveler resides |

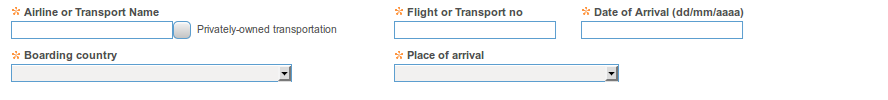

Figure 38

|

Space |

Amounts |

|

Flight number or Transportation Identification number |

If the traveler utilizes his/her own transportation, his/her identification should be stated in this space. Otherwise, insert the commercial transportation company’s number. |

|

Airline or transportation company |

If the traveler utilizes his/her own transportation, this space will be automatically filled in with “Own transportation” and will no longer be available to the traveler. Otherwise, the traveler should state the airline company used to enter the country or to be used to enter the country. |

|

Traveler’s own transportation |

If the traveler utilizes his/her own transportation, this space should be marked. On doing so, the space “Airline or Transportation Company” will be automatically filled in with “Own transportation” and will no longer be available to the traveler. |

|

Date foreseen for departure |

Date and time at which the traveler will leave Brazil. |

|

Destination |

Country of destination of the traveler. |

|

Departure site |

Location from which the traveler will leave Brazil. |

Once the information is completed, click “Advance” in order to visualize the Summary of the Declaration.

Tab “Summary of Declaration”

This tab presents the summary of the declaration.

The goods declared by the traveler are listed under “Baggage Restrictions”, broken down into their respective groups (Figure 39).

Figure 39

Saving and Transmitting a Declaration

If the traveler has goods to declare, the option “Save and transmit” will be available (Figure 39). By clicking on that option, the traveler will transmit his/her declaration to the Federal Revenue. At the end of the transmission, the message “Declaration transmitted successfully” will be exhibited, together with the respective registration number (Figure 40).

Figure 40

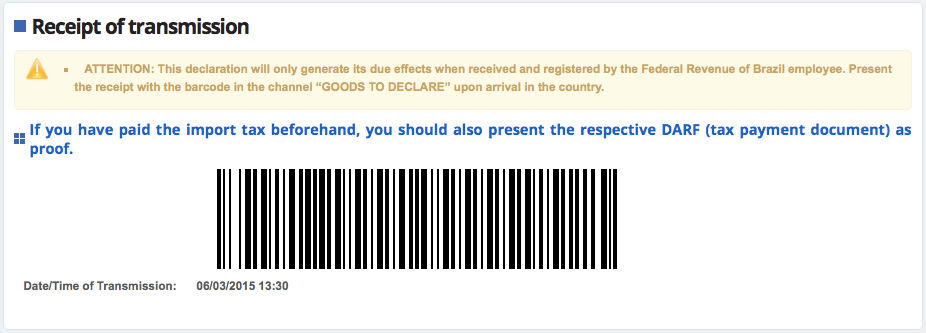

Aside from the message of success and the declaration number, the transmission receipt will also be exhibited containing the barcode of the declaration number (Figure 41).

Figure 41

There is no need for transmission if no goods are declared on the declaration. For this reason, the only option to be exhibited on the summary screen is “Save and transmit later” (Figure 42). On finalizing completion of the entire declaration and clicking on “Save and transmit later”, the message “Declaration saved successfully” will be exhibited together with the registration number. Later, the traveler may edit the declaration should he/she desire to make any alterations. To do this, one must inform the registration number of the declaration, together with that of the identification document.

!!!! Independently of whether it has been transmitted, a declaration will be valid for 30 days for purposes of consultation or editing. Once this period has elapsed, it will be necessary to register a new declaration. If the declaration already transmitted is presented to the Federal Revenue, it can still be consulted at any time.

Figure 42