Elaborating an Electronic Declaration of Traveler Goods

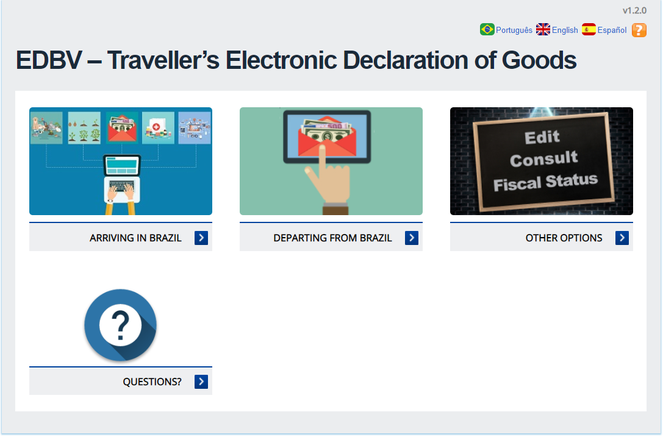

In order to fill out an Electronic Declaration of Traveler Goods, choose the option in the Initial Menu, "Arriving in Brazil" or "Departing from Brazil", as shown in the Figure 2.

Figure 2

Having chosen the right option, a series of questions will be asked, including the transportation modality used to enter the country, the traveler’s data and the goods brought from abroad. The information should be entered in the tab “Baggage Information”.

“Baggage Information” Tab - Answering the questions on the declaration

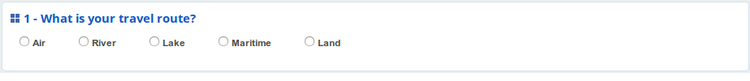

1) Question: What transportation modality was used?

- Air;

- River;

- Lake;

- Maritime;

- Land.

Having chosen the option, the traveler should answer the first question by informing the transportation modality utilized to enter the country, as shown in Figure 3.

Figure 3

Having selected one of the options, the next question will appear:

2) Question: What is your country of residence?

- Brazil: if the traveler lives in Brazilian territory

- Other country: if the traveler lives abroad.

Here, one should inform whether the traveler lives in Brazil or abroad, as shown in Figure 4.

Figure 4

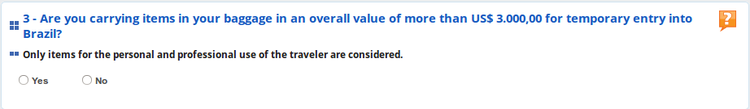

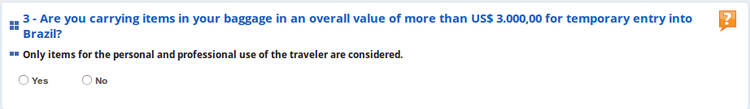

If you have chosen the option “Brazil”, the question under item 3 will appear. However, if you chose “Other country”, you should answer the question in item 2.1, informing whether you are bringing goods for temporary admission to Brazil: Figure 5, for air and maritime transportation modalities, or Figure 6, for all other modalities.

Figure 5

2.1) Question: Do you have items in your baggage with total worth of more than US$ 3,000.00 for temporary admission to Brazil?

- Yes: in this case, the goods entering the temporarily should be specified

- No: in this option, the question under item 3 will appear.

Figure 6

2.2) Question: Do you have items in your baggage for temporary entry into Brazil?

- Yes: in this case, the goods entering the country temporarily should be specified

- No: in this option, the question under item 3 will appear.

Informing as to Temporary Entry of Goods into the Country

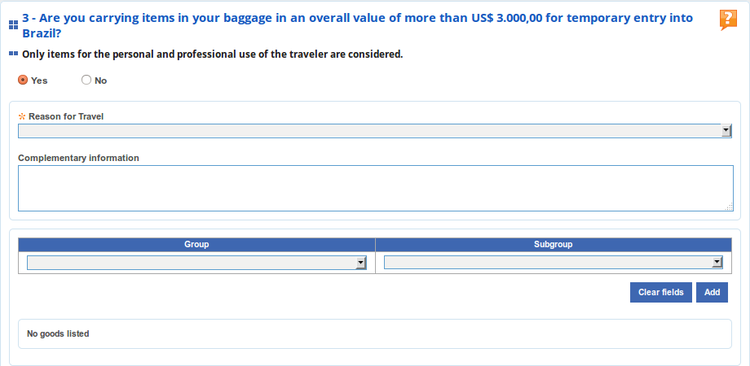

The traveler should fill out the spaces below informing as to temporary entry of items into the country, as shown in Figure 7.

Figure 7

| Space | Amounts |

| Purpose of your Trip | Predefined list of purposes |

| Complementary Information | Free text |

| Group | Predefined list of groups that characterize the items in question |

| Subgroup | For each group, there is a list of available subgroups. e.g, for the group “Electronics”, the subgroups are “Printer”, “Television”, “Tablet”, etc. |

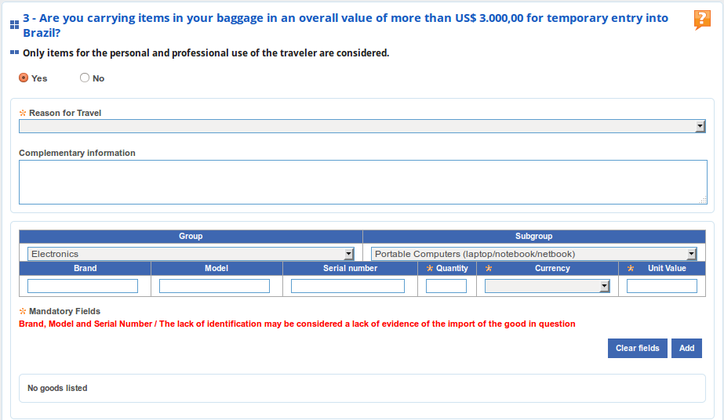

On indicating the group/subgroup, the information required for including the item will be provided, as shown in Figure 8. The traveler should click on “Include” in order to insert the item. If you desire to erase the spaces, click on “Clear”.

Figure 8

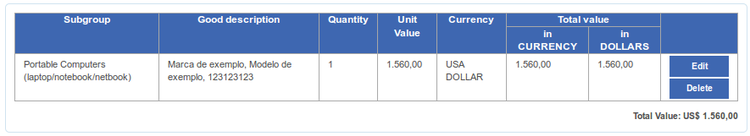

After inclusion, should you desire to rectify any information on the article inserted, click on “Edit”, or click on “Exclude” to remove the article inserted, as shown in Figure 9.

Figure 9

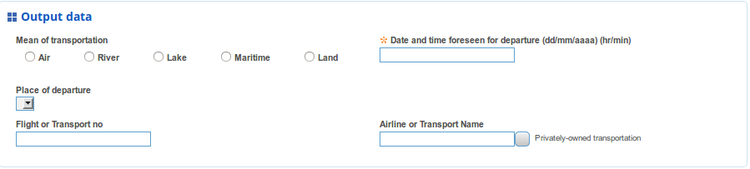

Finally, the traveler should fill out departure data (Figure 10).

Figure 10

|

Space |

Amounts |

|

Transportation modality |

Air, River, Lake, Maritime and Land |

|

Date and time foreseen for departure |

The date and time at which the traveler will leave the country |

|

Site of departure |

Listing of departure sites that may be used by the traveler to leave the country, depending on the type of transportation chosen at the beginning of the declaration. e.g., airports, ports, land border outposts, etc. |

|

Traveler’s own transportation |

Mark the space “Traveler’s own transportation” and indicate the automobile or motorcycle vehicle license or chassis number in the space “Flight number or Transportation Identification Number”. |

|

Flight number or transportation identification number |

Identify the mass transportation modality or the traveler’s own transportation |

|

Airline or transportation company |

If the traveler uses his/her own transportation, this space will be automatically filled in with the term “Own Transportation” and will not be available to the traveler. If not, the traveler should indicate the transportation company. |

The task of filling in data on the temporary entry of items into the country ends here. The next question to be answered in the declaration will then appear.

3) Question: Are you carrying animals, plants or their parts, including animal or plant origin products?

- Yes: in this case, the items in this category being brought into the country should be specified, as shown in Figure 11

- No: in this case, the next question will appear.

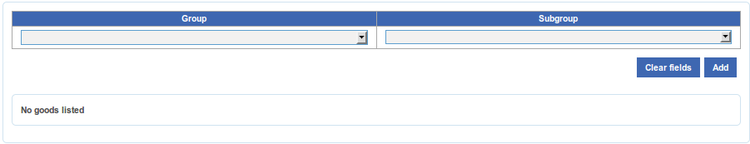

Figure 11

|

Space |

Amounts |

|

Group |

Predefined list of groups that classify the goods covered by this question |

|

Subgroup |

For each type of group, there is a list of available subgroups. e.g, for the group “Farm inputs”, there are subgroups “Seeds”, “Pesticides”, etc. |

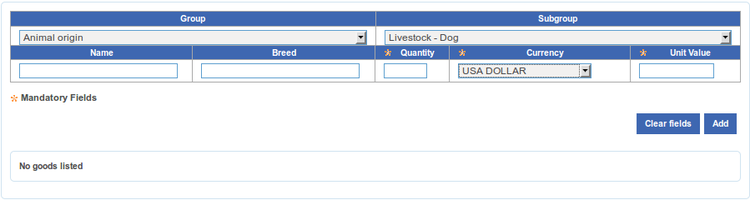

On indicating the group/subgroup, the information required for including the item will be provided, as shown in Figure 12. The traveler should click “Include” to insert the item. If you desire to erase the spaces, click “Clear”.

Figure 12

As already explained, information referring to an item varies according to the selected subgroup. However, in most cases, the spaces below will be available.

|

Space |

Amounts |

|

Quantity |

In numerical space. Indicate the quantity of the specified id. brought into the country. |

|

Currency |

Currency utilized in purchasing the item |

|

Unit value |

Numerical space: amount for which the item was purchased |

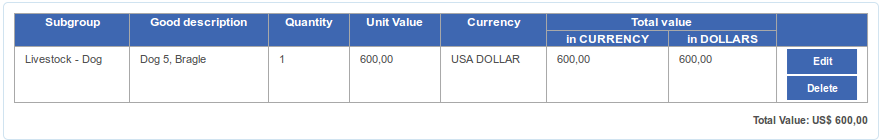

Should you desire to rectify any information on the article inserted, click “Edit”, or click “Exclude” to remove the article inserted, as shown in Figure 13.

Figure 13

Note: The procedure of distinguishing group and subgroup information is common to all questions in which it is necessary to specify the items brought into the country. Consequently, for purposes of simplification, detailing of this procedure will be omitted from this point forward.

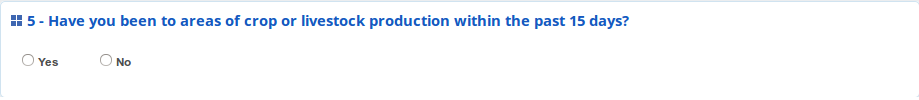

4) Question: In the last 15 days, have you visited areas of crop or livestock production (Figure 14)?

- Yes: in this case, the following message will appear: “You should contact Agricultural Surveillance”

- No: in this option, the next question will appear.

Figure 14

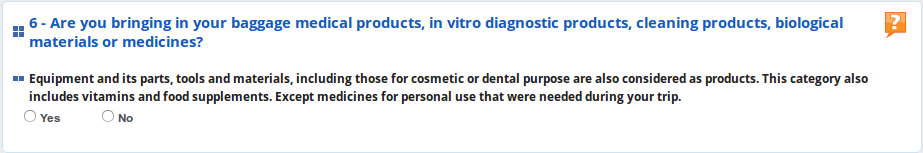

5) Question: Excluding those for personal use as required during your trip, do you have medical products and medicines in your baggage (Figure 15)?

- Yes: in this case, following the procedure detailed in the question under item 3, you should specify what items from this category you are bringing into the country.

Note: controlled goods in this category will be subject to analysis by the competent authority.

- No: in this case, the next question will appear.

Figure 15

6) Question: Do you have firearms or munitions in your baggage (Figure 16)?

- Yes: in this case, following the same procedure detailed in the question under item 3, you should specify what items from this category you are bringing into the country.

Note: firearms, munitions and other controlled goods in this category will be subject to analysis by the competent authority.

- No: in this case, the next question will appear.

Figure 16

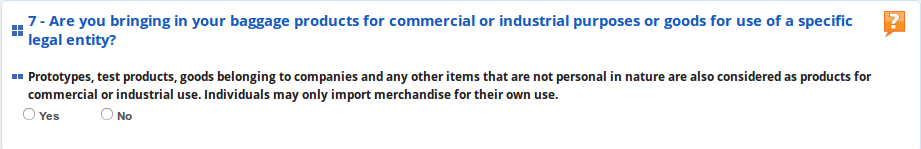

7) Question: Do you have products in your baggage for commercial or industrial purposes or goods for the use or consumption of a specific corporate entity (Figure 17)?

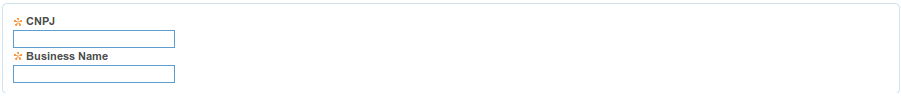

- Yes: in this case, you should indicate the CNPJ and Trade Name of the corporate person, or individual considered equivalent to the corporate person, as shown in Figure 18. At the same time, the goods from this category being brought into the country must be specified, following the same procedure detailed in the question under item 3

- No: in this case, the next question will appear.

Figure 17

Figure 18

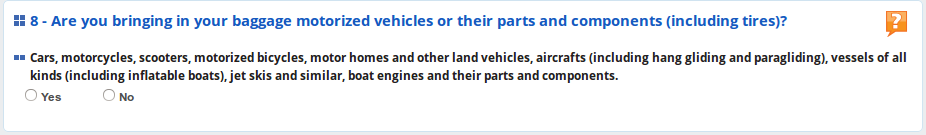

8) Question: Do you have motor vehicles or parts for vehicles, including tires in your baggage (Figure 19)?

- Yes: in this case, following the procedure detailed in the question under item 3, you should specify what items from this category you are bringing into the country.

- No: in this case, the next question will appear.

Figure 19

9) Question: Are you carrying or transporting cash in your baggage in an amount greater than the equivalent of US$ 10,000.00 (Figure 20)?

- Yes: in this case, following the procedure detailed in the question under item 3, you should specify what items from this category you are bringing into the country. Here, the amounts in each currency should be cited and will be automatically converted into Real.

- No: in this case, the next question will appear.

Figure 20

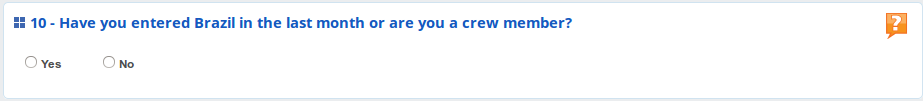

10) Question: Have you entered Brazil in the last 30 days or are you a crew member (Figure 21)?

- Yes

- No

Figure 21

In this case, there is no need for including additional information, but only to respond yes or no.

Note: in the case of an affirmative answer to the question, you will not be entitled to the import tax exemption on purchases abroad.

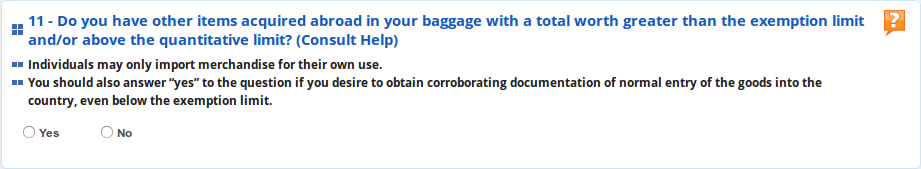

11) Question: Are you carrying other purchases made abroad in your baggage with a total worth greater than the overall limit? (Figure 22)

Yes: in this case, following the procedure detailed in the question under item 3, you should specify what items from this category you are bringing into the country. After declaring all of the items brought, you should click “Advance” so that the information from the tab “Traveler and Travel Data” can be inserted.

Nonresident travelers in the country must declare items in excess of the exemption limits that will not return abroad (goods for gifts or for personal consumption);

EXEMPTION LIMITS: (as stated in article 33, paragraphs 1 and 2 of RFB Normative Instruction no. 1059, dated August 2, 2010):

1) Air or Maritime Modality:

Overall limit: US$ 1.000.00

Quantitative limits:

Alcoholic beverages: 10 liters

Cigarettes: 10 packs of 20 units each

Cigars or cigarillos: 25 units

Tobacco: 250 g

Items with a unit value of up to US$10.00: total of 20 units, of which as many as 10 may be identical

Items with a unit value greater than US$10.00: total of 20 units, of which as many as 3 may be identical

2) Land, River or Lake Modalities:

Overall limit: US$ 500.00

Quantitative limits:

Alcoholic beverages: 10 liters

Cigarettes: 10 packs of 20 units each

Cigars or cigarillos: 25 units

Tobacco: 250 g

Items with a unit value of up to US$5.00: total of 20 units, of which as many as 10 may be identical

Items with a unit value greater than US$10.00: total of 20 units, of which as many as 3 may be identical

3) if you have entered Brazil in the last 30 days or are a member of the crew of the transportation modality, you are not entitled to the overall value and/or quantitative limits.

No: in this option, click “Advance” to continue; in the case of declarations filled in on movable equipment, including tablets and cell phones, the tab “Traveler and Travel Data” is automatically opened.

Note: as stated in the definition in article 2, item VII of RFB Normative Instruction no.1059, dated August 2, 2010, one is not required to declare goods of an obviously personal nature: those that the traveler needs for his/her own use, considering the circumstances of the trip and his/her physical condition, as well as portable goods required for professional activity to be carried out during the trip, excluding machines, devices and other objects that require some form of installation for their use, and cameras and personal computers.

Figure 22

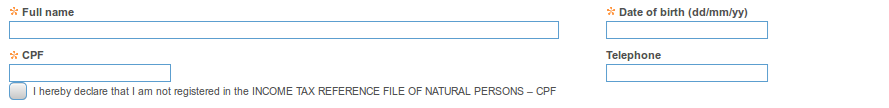

“Traveler and Travel Data” Tab

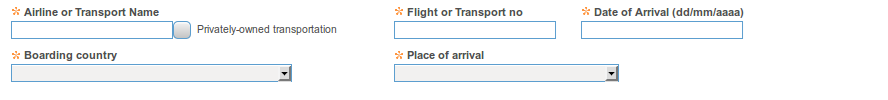

In this tab, one should fill out the following spaces (Figures 23, 24, 25 e 26):

Figure 23

|

Space |

Valuables |

|

Complete name |

Complete name of the traveler |

|

Date of birth |

Date of birth of the traveler |

|

CPF |

Registration in the Income Tax Reference File of Natural Persons |

|

I hereby declare that I am not registered in the INCOME TAX REFERENCE FILE OF NATURAL PERSONS – CPF. |

This space should be marked, if the traveler does not have a CPF number. |

|

Phone |

Number for purposes of contact, with the country code and area code |

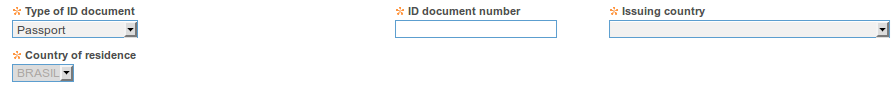

Figure 24

|

Space |

Amount |

|

Type of identification document |

Type of document to be presented for identification purposes |

|

Identification document |

Number of identification document |

|

Issuer country |

Country that issued the identification document |

|

Country of residence |

Country in which the traveler resides |

Figure 25

|

Space |

Amount |

|

Flight number or Transportation Identification number |

If the traveler utilizes his/her own transportation, his/her identification should be stated in this space. Otherwise, insert the commercial transportation company’s number. |

|

Airline or transportation company |

If the traveler utilizes his/her own transportation, this space will be automatically filled in with “Own transportation” and will no longer be available to the traveler. Otherwise, the traveler should state the airline company used to enter the country or to be used to enter the country. |

|

Traveler’s own transportation |

If the traveler utilizes his/her own transportation, this space should be marked. On doing so, the space “Airline or Transportation Company” will be automatically filled in with “Own transportation” and will no longer be available to the traveler. |

|

Date of arrival |

Date on which the traveler arrived/will arrive in Brazil. |

|

Country of origin |

Country of origin of the traveler. |

|

Place of arrival |

Location in which the traveler arrived/will arrive in Brazil. |

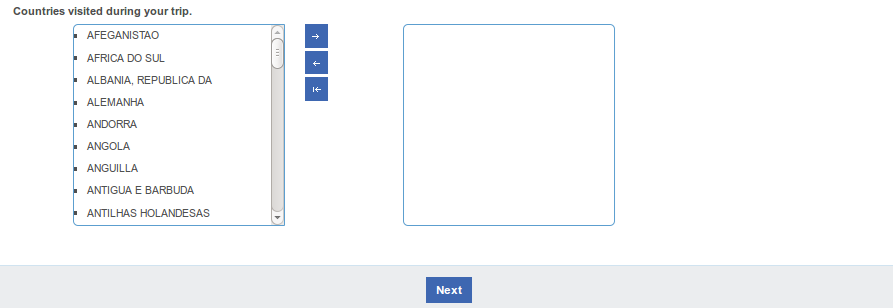

Figure 26

|

Space |

Amount |

|

Countries visited during your trip |

Countries visited by the traveler during the trip. You should click on the country to be inserted in order to select it and then on the arrows to add/remove from the list; in the version for mobile equipment, such as tablets and cell phones, it is enough to select the countries visited, clicking on each one and, when finished, clicking “Return” |

Once you have finished, click “Advance” to visualize the Summary of the Declaration.

Tab “Summary of Declaration”

This tab shows the summary of the declaration.

The goods declared by the traveler are listed under the item “Baggage Restrictions”, separated into their respective groups (Figure 27).

Figure 27

If the traveler declared items purchased abroad with a total worth that exceeds the exemption limit, the total import tax due will be shown, as indicated in Figure 28. If the total amount of the tax due is less than R$ 10.00, the system will indicate that there is no need for payment.

Figure 28

Saving and Transmitting a Declaration

If the traveler has goods to declare, the option “Save and transmit” will be available (Figures 27 and 28). On choosing this option, the traveler will transmit his/her declaration to the Federal Revenue. If there is nothing to correct at the end of the transmission, the following message will be exhibited “Declaration transmitted successfully”, together with the registration number (Figure 29).

Figure 29

Aside from the successful transmission and the declaration number, the transmission receipt will be exhibited, containing the barcode of the declaration number (Figure 30).

Figure 30

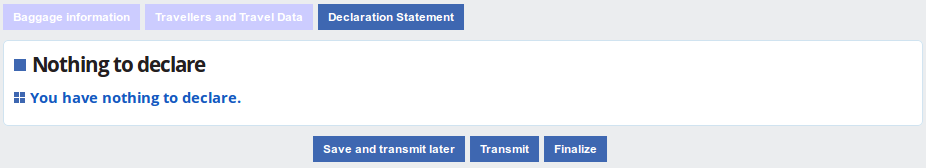

If there are no goods to be declared, there is no need for transmission. For this reason, only the option “Save and transmit later” is exhibited on the screen (Figure 31).

Figure 31

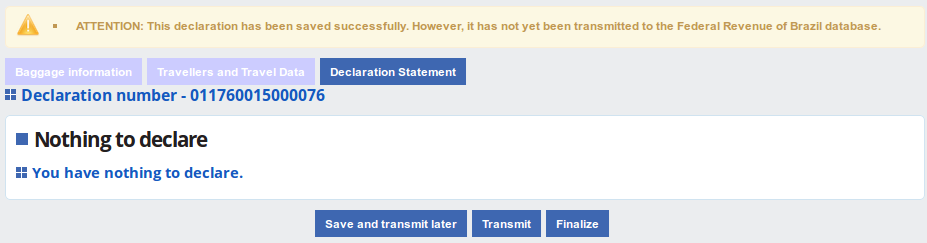

After completing the entire declaration and clicking “Save and transmit later”, the following message will be shown: “Declaration saved successfully”, together with the registration number (Figure 32). Later, the traveler may edit it, if he/she desires to include goods to be declared or make any other alterations. To do this, one must cite the registration number of the declaration, together with that of the identification document.

Note: whether transmitted or not, a saved declaration will be valid for 30 days for purposes of consultation or editing. Once this period has passed, a new declaration will have to be registered. If the declaration has already been transmitted and presented to the Federal Revenue, it may be consulted at any time whatsoever.

Figure 32