Consulting an Electronic Declaration of Traveler Goods

To consult an Electronic Declaration of Traveler Goods, one must go to the Initial Menu and choose the option “Other Options, as shown in Figure 43.

!!!!!!Independently of whether it has been transmitted, a declaration will be valid for 30 days for purposes of consultation or editing. Once this period has elapsed, it will be necessary to register a new declaration. If the declaration already transmitted is presented to the Federal Revenue, it can still be consulted at any time.

Figure 43

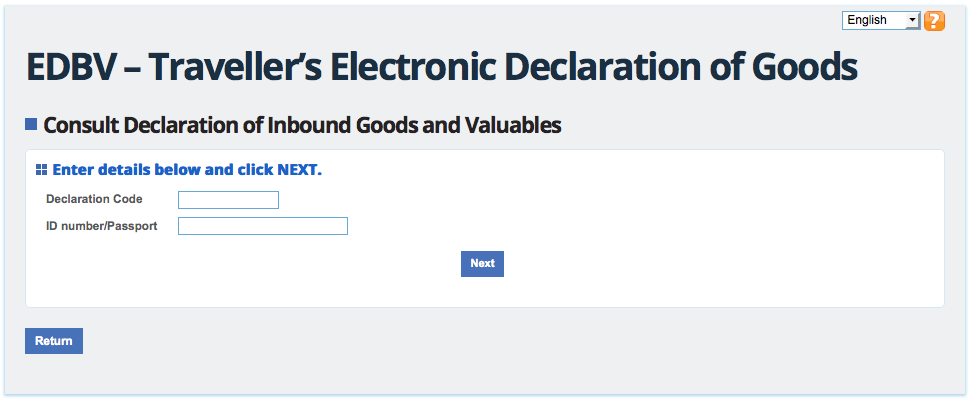

The screen for consulting the declaration will be exhibited, with the following spaces (Figure 44):

Figure 44

|

Space |

Amount |

|

Declaration code |

Number generated after saving the declaration |

|

Identification document/Passport |

Number of identification document indicated when filling out the declaration |

After filling out the declaration, click “Advance” in order to visualize the declaration.

Note: Declarations that have been saved but not transmitted cannot be consulted, only edited. Consulting is allowed only for declarations that have already been transmitted.

“Baggage Information” Tab – Consulting the Questions on the Declaration

Initially, the screen “Baggage information” will be exhibited. The questions answered by the traveler will be exhibited on this screen together with the responses given, as indicated in Figure 45:

Figure 45

Information on the declared goods will be shown as indicated in Figure 46:

Figure 46

“Traveler and Travel Data” Tab

To visualize traveler and travel data, click “Advance” or the corresponding tab. The screen “Traveler and Travel Data” will then be exhibited (Figure 47).

Figure 47

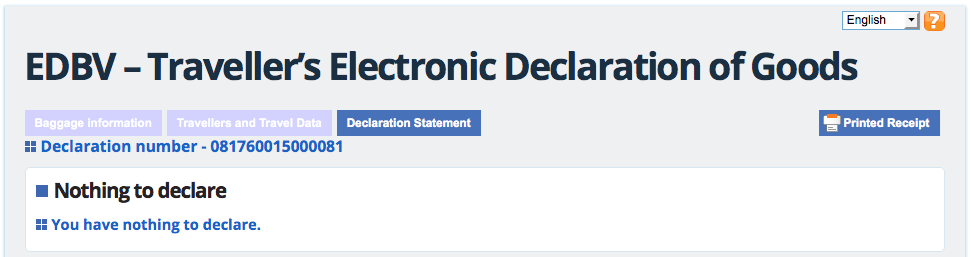

“Summary of Declaration” Tab

To visualize the declaration summary, click “Advance” or the corresponding tab. The screen “Summary of Declaration” will then be exhibited (Figure 48).

Figure 48

This screen shows a summary of the declaration. The goods declared by the traveler are listed under the item “Baggage Restrictions”, broken down into their respective groups.

Aside from the goods declared and the declaration number, the transmission receipt will also be exhibited together with the barcode of the declaration number (Figure 49).

Figure 49

If the traveler has not declared any goods, only the statement “Nothing to Declare” will be exhibited . If the total amount of the tax due is less than R$ 10.00, the system will indicate that there is no need for payment (Figure 50).

Figure 50