Goods to Declare, Tax Calculation and Payment

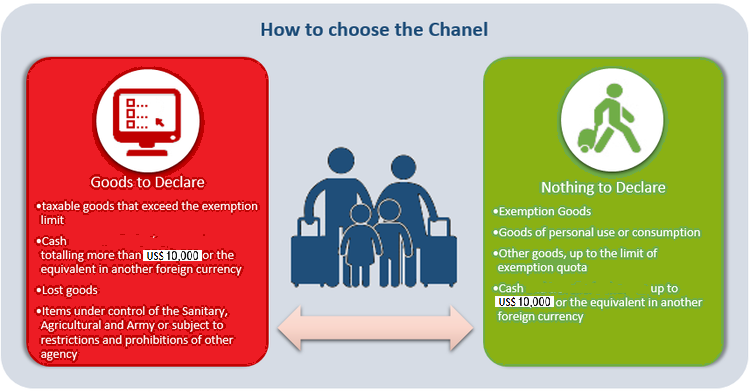

The traveler who has goods to declare must fill the Electronic Declaration of Travelers Goods (e-DBV). Upon arrival in Brazil, the traveler must choose one of the channels: "Nothing to Declare (Green)" or "Goods to Declare (Red)".

Where there is no “Goods to Declare” channel, the traveler must go to the customs supervision and submit their Electronic Declaration of Travelers Goods (e-DBV) before starting any inspection procedure.

NOTHING TO DECLARE

This channel should be chosen if the the traveler fits in one of the exemption cases.

If the traveler go to “Nothing to Declare” channel and is carrying goods which should have been declared, this option configures misrepresentation and loss of spontaneity to collect the tax due, punishable by a fine of 50% of the amount over the limit of exemption for the transport pathway used.

GOODS TO DECLARE

This channel should be chosen if the traveler has:

Goods which the overall value exceeds the exemption quota;

Goods which the overall value exceeds the exemption quota;

Lost goods;

Lost goods;

Cash when totalling more than US$ 10,000.00 or the equivalent in another currency, both at the exit of Brazil and upon arrival in the country;

Cash when totalling more than US$ 10,000.00 or the equivalent in another currency, both at the exit of Brazil and upon arrival in the country;

Items under control by Health Dpt, Agricultural Dept and Army or subject to restrictions and prohibitions of other agency;

Items under control by Health Dpt, Agricultural Dept and Army or subject to restrictions and prohibitions of other agency;

Items whose entry into the country the traveller wants to prove;

Items whose entry into the country the traveller wants to prove;

Goods that can not be considered as baggage (goods not included in the baggage concept) such as:

Goods that can not be considered as baggage (goods not included in the baggage concept) such as:

- Vehicles, motorcycles, scooters, motor with bikes, jet skis and similar, as well as their parts and accessories, engines and parts for ship and aircraft;

- Products under health surveillance for the provision of services to third parties;

- Goods that exceed the quantity limits;

- Goods for corporations for subsequent order in the Common Import Regime - RCI;

- Goods that the value exceed US$ 3,000.00 subject to special customs regime of temporary admission, this applies only for non-resident in Brazil.

The Declaration of Travelers Goods of childrens under sixteen (16) years must be made on their behalf by a parent or guardian.

!!!! The following items can not integrate the baggage of children under age, even when accompanied by their legal representatives: alcoholic beverages, tobacco products or other products containing ingredients that can cause physical dependence or chemistry.

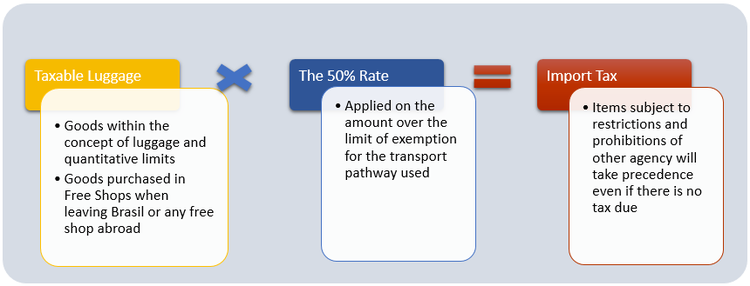

SPECIAL TAXATION REGIME (RTE) - CALCULATION OF THE IMPORT TAX

The 50% rate of Import Tax apply on luggage that exceeds the limits of the exemption quota value in compliance with the quantitative limits.

The exchange rate used will be the current on the date of transmission of the Electronic Declaration of Travelers Goods (e-DBV).

!!!! The exemption quota is valid for all travelers and will be granted to each interval of thirty (30) days, after the arrival of the last international trip, regardless of the payment of taxes.

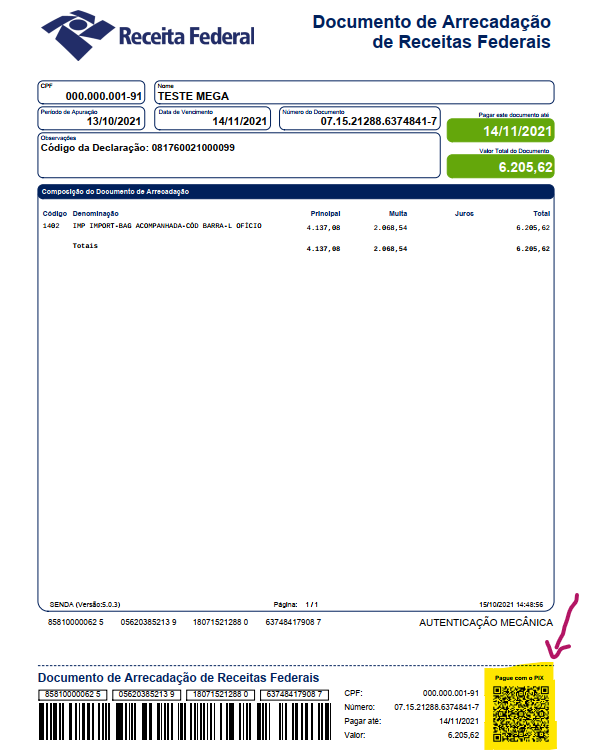

PAYMENT

Should be done through DARF - Internal Revenue Collection Document, that is generated by the System e-DBV, and the payment can be done in the following ways:

Debit Card - in the Customs Service desk;

Debit Card - in the Customs Service desk;

Home Banking

Home Banking

Self Service Terminals

Self Service Terminals

Advance payment streamlines the passage through customs. In this case, the exchange rate to be considered is the current in the date of submission of the declaration by the traveler, except in the case of inaccurate declaration.

The goods will be hold if the traveler choose to pay tax at a later time or if they need to be approved by other agencies.

The withdrawal of retained goods can be done within 45 (forty five) days, directly by the traveler, or by an authorized representative, in the customs unit that has jurisdiction over the place where the goods are. Inquire about service schedules and required documents before you go to the customs unit.

At land borders, it should be noted the bank opening hours and the availability of debit machines. Outside those schedule, payment can only be made through ATMs of the Bank of Brazil and the Post Office.

The DARF generated by the e-DBV system now allows instant payment (PIX). See below the generated DARF model, with presentation of the quick response code (QR Code) for payment by PIX:

THE COMMOM IMPORT REGIME FOR BAGGAGE

The goods brought by travelers which are not in the exemption quota or can not be subject to Special Taxation Regime (RTE), will be subject to the Common Import Regime (RCI).

Goods excluded from the concept of luggage; and

Goods excluded from the concept of luggage; and

Goods that exceed the quantity limit; and

Goods that exceed the quantity limit; and

Goods in unaccompanied baggage that do not reach the country within three months before or six months after the arrival of the traveler; or that are not from the countries of stay or origin of the traveler.

Goods in unaccompanied baggage that do not reach the country within three months before or six months after the arrival of the traveler; or that are not from the countries of stay or origin of the traveler.

The granting of the Import Regime occurs through the presentation of an Import declaration, formulated in the Integrated Foreign Trade System (SISCOMEX), and must satisfy all the standards for importation.

This procedure is not so simple to be done for people not used to the customs procedures. It is advisable that travelers look for a Customs unit to inquire about the procedures and deadlines.