Exemptions, quotas, quantity limits and Duty free

EXEMPTION FOR ACCOMPANIED BAGGAGE

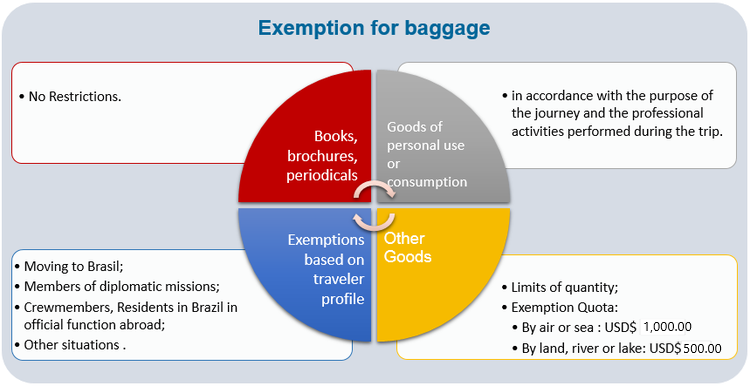

Books, brochures, periodicals and goods of personal use or consumption are exempt from paying taxes.

For exemption purposes, goods of personal use or consumption should observe the following cumulative conditions:

a) The good must be for the traveler's use;

b) The acquisition of goods should be required in accordance with:

the purpose of the journey;

the purpose of the journey;

the traveler´s physical condition;

the traveler´s physical condition;

the professional activities performed during the trip.

the professional activities performed during the trip.

c) the goods must be used;

d) the nature and quantity of the goods must be compatible with the purpose of the trip.

The duty-free goods do not need to be declared once they are free of charge (tax payment) and they do not take part when calculating the exemption quota, unless you want to secure their entry in the country.

!!!! The traveler can only bring goods for their own use or household use.

EXEMPTION QUOTA FOR ACCOMPANIED BAGGAGE

The goods that are not specifically intended for personal use or consumption will only be exempt if they are within the concept of luggage and up to the limit of one of the specific quotas:

USD$ 1,000.00 or the equivalent in another currency, when the traveler enters the country by air or sea; and

USD$ 1,000.00 or the equivalent in another currency, when the traveler enters the country by air or sea; and

USD$ 500.00 or the equivalent in another currency, when the traveler enters the country by landborder, river or lake.

USD$ 500.00 or the equivalent in another currency, when the traveler enters the country by landborder, river or lake.

The exemption quota will be formed by the goods subject to payment of tax, provided they are within the concept of accompanied baggage.

Exemption quota for accompanied baggage is individual and non-transferable, this means that you can not combine the individual quotas to benefit from the exemptions, even among family members.

Alcoholic beverages, tobacco products or other products containing ingredients that can cause physical dependence or chemical may not integrate the baggage of children or adolescents, even when accompanied by their legal representatives.

QUANTITY LIMITS

To enjoy the exemption for accompanied baggage, in addition to the value of quota, it is necessary to pay attention in the following quantity limits:

|

Goods |

By air or sea |

By land, river or lake |

|

Alcoholic Beverage |

12 liters, in total |

12 liters, in total |

|

Foreign-made cigarretes |

10 packs, in total, each containing 20 units |

10 packs, in total, each containing 20 units |

|

Cigar and Cigarillos |

25 units, total |

25 units, total |

|

Tobacco |

250 grams, in total |

250 grams, in total |

|

Other goods |

Worth up to US$ 10.00: 20 units in total, up to 10 identical units |

Worth up to US$ 5.00: 20 units in total, up to 10 identical units |

|

Other goods |

Exceeding US$10.00: 20 units in total, up to 3 identical units |

Exceeding US$ 5.00: 20 units in total, up to 3 identical units |

If you exceed the limits, the goods taxes will be rcalculated due in accordance with the Common Import Regime - RCI, provided the amount does not reveal commercial destination.

EXEMPTIONS BASED ON TRAVELER PROFILE

| Traveler Profile | Time of Residence Abroad | Goods Exemption |

| Immigrants or Brazilians returning to the country permanently | More than 1 (one) year - Occasional trips to Brasil do not affect the time count, provided they do not totalize more than 45 days in the previously 12 months from the return to the country. | New or used: furniture and other household goods; and tools, equipaments and instruments necessary for their profession, art or craft. |

| Members of diplomatic missions, consular offices and representatives of international organizations | There is no deadline | Everything, including luggage and cars. |

| Scientists, engineers and technicians, living abroad | There is no deadline, but there are conditions to be observed | New or used: furniture and other household goods; and tools, equipaments and instruments necessary for their profession, art or craft. |

| Residents in Brazil in official function abroad | There is no deadline | Cars, under certain conditions and limitations. |

| Crewmembers | There is no deadline | Only goods for personal use or consumption, books, brochure and periodicals. |

| Crew of long-haul ship when disembark definitively in Brazil | It may be exercised once every one (1) year range. | Everything, respecting the quota limits and tax of 50% on the surplus. |

| Military and civilian on military vehicles | It may be exercised once every one (1) year range. | Everything, respecting the quota limits and tax of 50% on the surplus. |

!!!! New goods must be accompanied by documentation of acquisition or justification for the possible non-existence, and the non-submission may lead to application of special procedures.

DUTY FREE/FREE SHOP

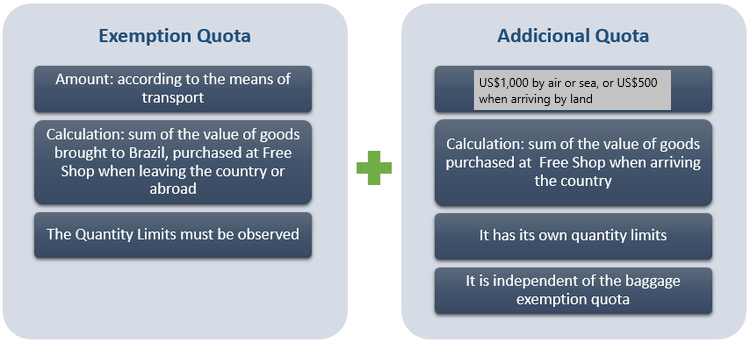

Shopping in a Free Shop when leaving Brazil and abroad can be included by the baggage exemption quota. Upon arriving in Brazil, the traveler is entitled an additional quota in the Free Shop of entrance in the country. It´s importante to notice how the quota is formed in each case:

SHOPPING IN FREE SHOPS WHEN LEAVING BRAZIL OR FREE SHOPS ABROAD

Goods purchased in Free Shops when leaving Brasil or any free shop abroad or in shops, catalogs and Duty Free exhibition on buses, aircraft or vessels travel are considered traveler´s luggage and part of the quota.

SHOPPING IN FREE SHOPS WHEN ARRIVING IN BRAZIL

The traveler has a extra quota of US $ 1,000.00 for purchases in the duty free shops of the first landing airport in Brazil.

Children under eighteen (18) years can not purchase alcoholic drinks and tobacco products even when accompanied.

QUANTITY LIMITS OF EXTRA QUOTA

Purchases at Free Shop stores upon arrival in Brazil are subject to the following quantitative limits

Alcoholic Beverages

If arriving by land border: 12 (twelve) liters of alcoholic beverages; and

If arriving by port or airport: 24 (twenty-four) units of alcoholic beverages, observing a maximum quantity of 12 (twelve) units per type of beverage;

20 (twenty) packs of cigarettes;

25 (twenty-five) units of cigars or cigarillos;

250 g (two hundred and fifty grams) of tobacco prepared for pipe.