Notícias

TRANSACTION

CADE conditionally clears consortia for sharing LPG operational structures

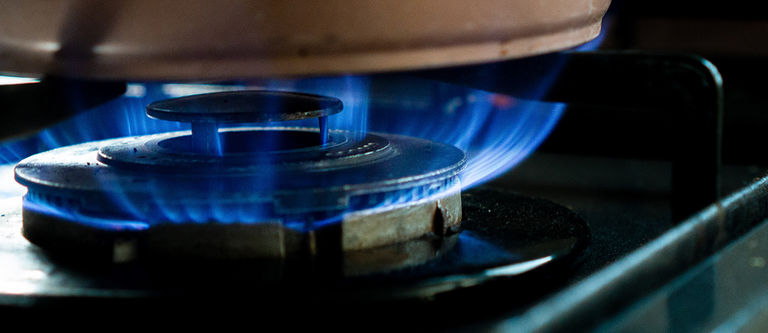

On 16 August, the Tribunal of the Administrative Council for Economic Defense (CADE) conditionally cleared the consortia Azul and Superdourado amongst the companies Ultragaz, Bahiana Distribuidora, Supergasbras, and Minasgás. The agreements establish the sharing of operational structures for packaging and loading of Liquefied Petroleum Gas (LPG) in bulk, a kind of gas known for its domestic use in Brazil. The transaction was approved upon the signature and fulfilment of a merger control agreement.

Ultragaz and Bahiana are wholly-owned subsidiaries of Ultrapar, part of the Grupo Ultra, which operates in the Brazilian Midwest, Southeast, and South through Ultragaz, and in the Brazilian North and Northeast through Bahiana. Supergasbras and Minasgás are firms of the SHV group. Both operate together in the Brazilian territory except in the states of Acre, Amapá, Amazonas, Roraima, and Rondônia.

In March 2023, the Office of the Superintendent General of CADE unconditionally cleared the transaction. In April, Copa Energia, a third party interested in the merger, presented an appeal against the judgement and the case was submitted to the Tribunal.

The consortia involve 35 LPG production bases in 15 Brazilian states. However, there were competition concerns only in Bahia, Espírito Santo, Minas Gerais, Rio de Janeiro, and Paraná, states in which all the companies have facilities and high levels of market share.

According to Commissioner Luiz Hoffmann, the competitive dynamic shows that the common use of facilities in Bahia is more related to cost efficiency than to assets overlap and this is due to the fact that the bases are geographically distant and the firms have already hired services of one another to meet needs of areas they cannot supply. In Minas Gerais, the dynamic of the LPG market also suggests that the transaction has no impact in the competitive environment, due to the presence of other competitors in the region, among others.

Agreement

To mitigate the competition concerns identified in the analysis of the transaction, the companies signed a merger control agreement committing to comply with the established obligations.

The provisions determine a reduction of the duration of the contracts from 35 years to 13 years. If there is interest in the renewal, the signatories must submit the renewal term to CADE wich will analyse the case as a new merger.

The agreement also establishes the termination of the preemptive right to invest together in the construction of a new packaging unit and determines the adoption of an open door policy, giving CADE access to the facilities of the signatories for inspection.

To ease the entry of new companies in the packaged LPG market, the parties signed a commitment to grant access to the facilities for third parties, in addition to the yield of space, loading, packaging, and storage.

As a structural remedy, firms committed to eliminate from the scope of the transaction the sharing of bases and their operational activities in the states of Espírito Santo and Rio de Janeiro. The document prohibits any type of favouring, cooperation, or coordination in these states, except for the cases in which they are expressly provided in the sectoral regulation or competition law.

The restrictions prevent competitive harm to the market of LPG in bulk, “and promote the competition environment, balancing the risks of lack of incentives that could arise after the creation of the consortia”, Hoffmann stated.

Access Merger no. nº 08700.004940/2022-14.