Investment Opportunities in Brazil

- Highlights 2025

- Concession and Production-Sharing Regimes

The discovery of the Pre-salt Polygon in 2007 led the Brazilian government to establish the Production-Sharing Regime in 2010. Before that, all areas were under a Concession Regime. Since then, Brazil has operated with a mixed regulatory regime.

How the Concession Regime Works

Under the Concession Regime, the concessionaire assumes the risk of investing to discover oil or natural gas. It will then have ownership of any oil and gas discovered in the concession area.

In the bidding rounds, the company or consortium that submits the most advantageous bid, in accordance with the terms of the tender protocol, is awarded the right to explore the area to verify the existence of oil or natural gas deposits.

On that occasion, interested companies or consortia offer an amount for the signature bonus and propose a Minimum Work Program (PEM). This program details the activities, such as seismic surveys and well drilling, that the concessionaire commits to carrying out in the concession area.

Under a concession contract, the concessionaire shall pay various government-take components, such as the signature bonus, royalties, annual acreage fees for onshore blocks, and a special participation for fields that produce large volumes.

The Brazilian National Agency of Petroleum, Natural Gas and Biofuels (ANP) signs these contracts on behalf of the Union – the federal entity of Brazil, which has its own legal personality, collects taxes, owns property, and represents the country abroad.

How the Production-Sharing Agreement Works

For areas in the Pre-Salt Polygon and other strategic areas, the Brazilian National Council for Energy Policy (CNPE) decides whether to hold bidding rounds or directly contract Petrobras. The objective is to safeguard national interests and meet energy policy goals. In both situations, contracts are signed under the production-sharing regime.

If the CNPE decides to hold a bidding round, Petrobras has the preferential right to operate the blocks. If Petrobras chooses to exercise this right, it must indicate the areas of interest and its participation in the consortium, which must be at least 30%.

The CNPE defines the blocks and the technical and economic parameters of the production-sharing agreement, while the ANP organizes the bidding round. The Ministry of Mines and Energy (MME) sets the guidelines for ANP to follow when preparing the bidding documents and contracts, which are later approved by the ministry.

In production-sharing bidding rounds, the winner is the one offering the Brazilian State the largest share of oil and natural gas, that is, the largest portion of exceeding oil.

The consortia exploring a pre-salt area are necessarily composed of a state-owned enterprise, Pré-Sal Petróleo S.A. (PPSA), representing the Union, and the winning companies. The contracts are signed by the MME on behalf of the Union.

- How to contract areas for exploration and production in Brazil

In Brazil, there are two ways to contract areas for oil and natural gas exploration and production: bidding or farm-in.

Bidding

It is the tender process in which companies submit formal proposals and bids to acquire rights to an area for oil and gas exploration. This process can occur through:

- Traditional Bidding Rounds – The government publishes a notice with the rules, the evaluation criteria, and the areas on offer. Companies then have a set period to study the areas before submitting bids in a public session. It is applied both to concession and production-sharing agreements.

- Open Acreage System – It is a continuous bidding process that allows companies to express interest in and bid on available exploration blocks throughout the year. Companies from anywhere in the world may also suggest new areas, subject to ANP’s review and approval. It contrasts with traditional Bidding Rounds, which have specific calendar dates. The system covers both onshore and offshore areas, including the pre-salt polygon. This is now the main model used in Brazil. Read more about Open Acreage in the next section.

Explore opportunities and updates at Rounds ANP.

Farm-in

It is a commercial agreement whereby a company or consortium acquires a partial working interest in an exploration concession or block from another company or consortium, which is the original rights holder. In simple terms, it represents the entry of a new partner into an oil exploration or production project.

- Open Acreage

Since CNPE Resolution No. 27/2021 took effect in December 2021, the Open Acreage system has been the main model for conducting tenders for new oil and gas exploration areas. This system operates under two distinct modalities:

- Production-Sharing Open Acreage (OPP), for strategic areas and the Pre-salt Polygon; and

- Concession Open Acreage (OPC), for all other areas.

Nomination of areas by economic agents

The ANP Resolution No. 837/2021 is a key regulation for the nomination of areas by oil and gas companies from anywhere in the world. This resolution creates a process for the market to suggest new areas of interest for the Open Acreage.

Additionally, it allows companies to change the design of existing blocks to better match identified prospects, leads, or even clusters of structures, making these areas more attractive.

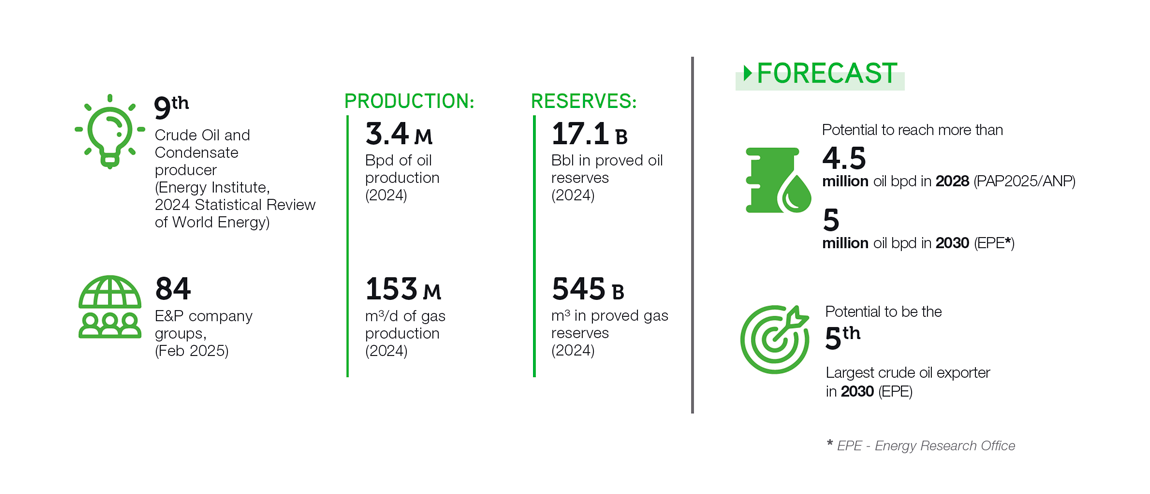

Outcome of the Open Acreage O&G Bidding Rounds

Concession: Four cycles; 306 exploratory blocks and areas awarded; BRL 2.878 billion (≈ USD 480 million) in minimum investment and BRL 921 million (≈ USD 153 million) in signature bonuses.

Production Sharing: Two cycles; five exploratory blocks awarded; BRL 2.16 billion (≈ USD 360 million) in minimum investment and BRL 930 million (≈ USD 155 million) in signature bonuses.

Opportunities in the Open Acreage

As of Setember 2025, 176 exploration blocks are available through the Open Acreage of Concession (OPC). In addition, 1,673 blocks are being evaluated, along with 8 marginal oil accumulation fields, for possible inclusion in the OPC in the future.

And 13 exploration blocks are available through the Open Acreage of Production Sharing (OPP), of which 7 are being offered in the ongoing 3rd cycle of the OPP. Additionally, 15 blocks are being evaluated for possible inclusion in the OPP in the future.

Explore opportunities and updates at Rounds ANP.

- Onshore Frontier Basins

-

The Paraná basin is a vast Paleozoic basin with hydrocarbon generation mainly associated with atypical petroleum systems with the presence of diabase sills in contact with the source rock, particularly from the Devonian period. These sills also serve as traps, seals and even reservoirs. All these basins hold potential for natural gas discoveries and, potentially, condensate and light oil.

In the Paraná basin, the Barra Bonita field resumed its natural gas production in 2022 in after it was bought by Barra Bonita Óleo e Gás. Also, regional seismic surveys contracted by ANP have revealed structures like those observed in the Gaviões Cluster of the Parnaíba basin.

The Parecis Basin, recently dated to the Proterozoic era and reinterpreted, has undergone regional seismic surveys contracted by ANP. These surveys indicate the presence of significant structures capable of storing substantial volumes of natural gas within the blocks offered. Recent wells have confirmed the presence of potential reservoir rocks in at least three intervals, with indications of mature source rocks.

The Tucano Sul and Tucano Central basins belong to the same rift system as their neighboring Recôncavo basin. Presently, there are five active gas fields and three marginal accumulations in the Tucano Sul Basin.

There is currently one block available through the Open Acreage system within the onshore frontier basins and an additional stock of 53 blocks for future inclusion on the Open Acreage as summarized in the table below.

Basin

Blocks Available

Blocks in stock

Paraná

0

32

Parecis

1

0

Tucano Sul and Tucano Central

0

21

- Paraná Basin

Paraná Basin is in the most industrialized region of South America. It holds promising potential for natural gas accumulations, with one field already in production. The basin encompasses two petroleum systems, evidenced by oil and gas shows encountered in various drilled wells and the Barra Bonita natural gas field.

The expected exploration play in the Paraná Basin is like the Gaviões Cluster in the Parnaíba Basin, with diabase sills playing a crucial role in controlling natural gas accumulations.

There is a stock of 32 blocks in this basin for future inclusion in the Open Acreage.

- Parecis Basin

Situated in the central-west region of Brazil, the Parecis Basin is an intracratonic basin located in the southeastern part of the Amazonian Craton. It spans approximately 350,000 km² of sedimentary area and is near regional centers such as Goiânia, Brasília, Cuiabá, and Campo Grande. The potential in this basin is primarily associated with natural gas discoveries.

For many years, the Parecis Basin was believed to be of Paleozoic origin. However, with the acquisition of new seismic data and the drilling of new wells, including those contracted by the ANP (2-ANP-4-MT and 2-ANP-6-MT), it’s now considered as a Neoproterozoic basin.

The basin also benefits from the availability of high-quality regional seismic datasets, which have been contracted by the ANP and are accessible to the public for download. These datasets provide valuable information and insights into the geological characteristics of the basin, aiding in exploration and resource assessment efforts. Researchers and industry professionals can freely access and download these datasets to further analyze the basin's geology and better understand its potential for hydrocarbon exploration and production.

There is one block available in the Open Acreage in this basin.

- Tucano Sul and Tucano Central Basins

The Tucano Sul and Central Basins, situated in the northeastern region of Bahia state, are characterized by an elongated N-S half-graben structure, with the eastern part exhibiting faulted borders. These basins are part of the larger Meso-Cenozoic Recôncavo-Tucano-Jatobá basin system. The Tucano Sul basin encompasses five fields that are currently producing natural gas.

In the first three cycles of the Open Acreage system, a total of seven blocks were acquired in the Tucano Sul basin. There is a stock of 21 blocks in the Tucano Sul basin for future inclusion in the Open Acreage.

-

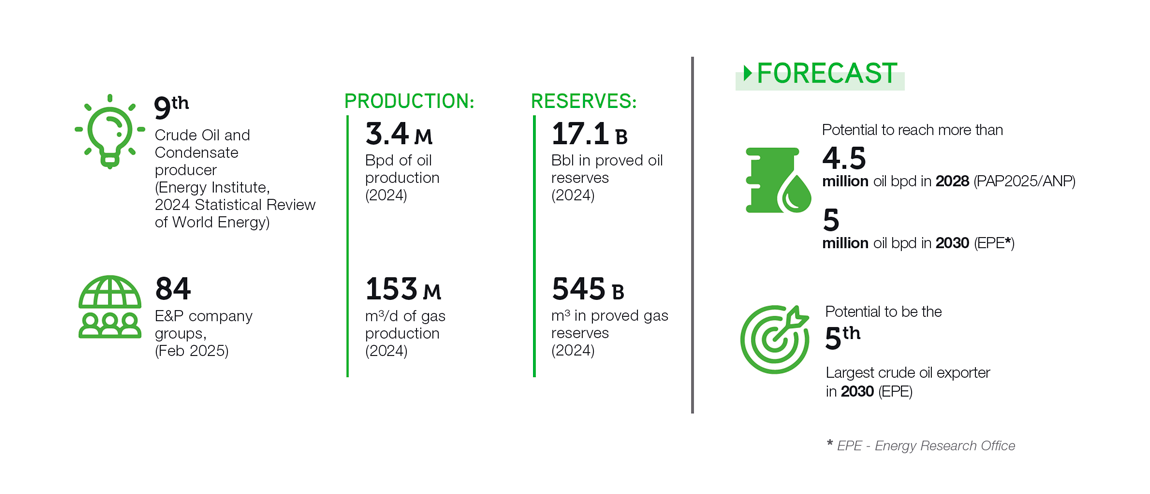

- Offshore Equatorial Margin Basins

-

The Brazilian Equatorial Margin comprises five sedimentary basins, with three of them having available blocks in the Open Acreage. This region is considered highly prospective for significant hydrocarbon discoveries in frontier areas. While some areas exhibit geological similarities to recent discoveries in Guyana, and Suriname, there are also local characteristics that make each basin unique. Notably, exploration opportunities have been identified at various stratigraphic levels, potentially concentrated in reservoir clusters. These opportunities have been thoroughly evaluated using up-to-date seismic data, allowing for a comprehensive understanding of the petroleum systems.

Historically, exploration efforts in the offshore portion of the Brazilian Equatorial Margin have primarily focused on shallow waters. However, the latest geological model, based on new seismic data, suggests that the most promising opportunities lie in deep and ultra-deep waters. This highlights the vast untapped potential awaiting further exploration.

There is currently one block available through the Open Acreage system within the offshore equatorial margin basins and an additional stock of 206 blocks for future inclusion on the Open Acreage as summarized in the table below.

Basin

Blocks Available

Blocks in stock

Foz do Amazonas

0

157

Ceará

1

42

Offshore Potiguar

0

28

- Foz do Amazonas Basin

The 11th bidding round, which took place in 2013, marked the revival of bidding rounds in Brazil after a five-year hiatus. This event sparked the interest of major players in the Brazilian Equatorial Margin, particularly in the Foz do Amazonas Basin.

Subsequent internal studies conducted by ANP, as well as studies conducted by operators, confirmed the potential of the acquired blocks. However, to date, no wells have been drilled in these blocks due to the inability to obtain a drilling license.

These seismic and geological evaluations have revealed significant similarities between deep-water structures in the basin and the accumulations recently discovered in Guyana. The basin is characterized by the presence of sandstone turbidite reservoirs from the Cretaceous period, possibly charged by marine source rocks. This indicates the promising potential for hydrocarbon exploration and production in the basin.

In the 5th cycle of the Open Acreage of Concession, 19 blocks were acquired in the Foz do Amazonas basin, of which 7 with competition, raising a total signature bonuses of BRL 844 million (≈ USD 141 million) and forecast investments in the exploration phase of BRL 1.009 billion (≈ USD 168 million). This was the first time that areas in this region were offered under the open acreage modality.

There is a stock of 157 blocks in this basin for future inclusion in the Open Acreage. - Ceará Basin

The Ceará Basin originated from the separation of the paleocontinent Gondwana during the Early Cretaceous period. Its tectono-sedimentary evolution began in the Eo-Aptian stage, and its sedimentary fill can be divided into three main sequences: Rift, Post-Rift, and Drift.

In the Brazilian Equatorial Margin, both the Ceará basin and the offshore Potiguar basin, offer exploration opportunities in the Drift section, which includes sandstone turbidite reservoirs. However, the Rift and Post-Rift sections are considerably thick and represent significant exploration targets, especially in structural traps composed of carbonate and sandstone formations.

Currently, the Ceará Basin has four oil fields in production in shallow waters: Atum, Curimã, Espada, and Xaréu. These fields are important in confirming hydrocarbon generation in the marine portion of the basin. However, the focus of current exploration efforts has shifted towards deeper waters. Recent seismic data, both 2D and 3D, has identified compelling exploration opportunities across various stratigraphic intervals within the basin.

There is one block available in the Open Acreage in this basin. Also, there is an additional stock of 21 blocks for future inclusion in the Open Acreage.

- Ceará Basin

- Offshore Potiguar Basin

The offshore Potiguar Basin has four oil-producing fields: Agulha, Arabaiana, Cioba, and Ubarana, as well as two gas-producing fields: Oeste de Ubarana and Pescada.

In 2014, a significant discovery was made in the deep waters of the Potiguar Basin with the Pitu prospect (1-BRSA-1205-RNS). The well discovered oil in the Alagamar formation and gas in the Pescada formation, both in good quality reservoirs.

While the offshore Potiguar Basin is still considered a frontier basin, it has a long history of oil production in onshore and shallow water areas. In the deepwater region, there is potential for oil discoveries in Upper Cretaceous turbidite reservoirs, like the plays found in the West African Margin (such as Jubilee) and the Liza-Payara Complex in Guyana. The Pitu prospect confirmed the presence of structural traps in the Post-Rift section and the existence of source rocks in the oil window in deep waters.

There is a stock of 28 blocks in this basin for future inclusion in the Open Acreage.

-

- Offshore Eastern Margin Basins

-

There are currently 174 blocks available through the Open Acreage system within the offshore eastern margin basins and an additional stock of 698 blocks for future inclusion on the Open Acreage as summarized in the table below.

Basin

Blocks Available

Blocks in stock

Campos

15

50

Offshore Espírito Santo

10

11

Pelotas

0

309

Pernambuco-Paraíba

0

5

Santos

149

323

- Pernambuco-Paraíba Basin

Pernambuco-Paraiba Basin, one of the least explored marine basins in Brazil, has yet to see any drilling activity despite its vast area of 212,901 km². It’s divided in two sub-basins: Pernambuco end Paraíba sub-basins. The Pernambuco Lineament acts as the internal division between the sub-basins.

The Marogogi High marks the southern boundary between the Pernambuco sub-basin and the Sergipe-Alagoas Basin, while the Touros platform serves as the northern limit of the basin.

Laboratory analysis of piston core ocean floor samples has revealed the presence of oil and gas in the collected sediments, indicating the existence of an active petroleum system. Although the available two-dimensional seismic data is limited, it suggests sufficient sedimentary thickness and the potential presence of reservoirs.

There is a stock of cinco blocks in this basin for future inclusion in the Open Acreage.

- Offshore Espírito-Santo Basin

The offshore Espirito Santo Basin has a long history of oil and natural gas production in both shallow and deep waters, particularly through the Golfinho oil and gas fields complex.

Currently, there are six prospects under evaluation in at offshore Espírito Santo basin, they belong to two prospect clusters, namely the Cachorros Cluster (Dogs Cluster) and Doces Cluster (Candies Cluster). These discoveries are characterized by late Cretaceous to Neogene sandstone turbidite reservoirs, which occur in structural, stratigraphic, and mixed traps.

There are 10 offshore blocks available in the Open Acreage in this basin.

- Offshore Espírito-Santo Basin

- Campos Basin

The Campos Basin, the second most productive in Brazil, is known for its oil and gas production from various reservoirs, including Post-salt sandstone turbidites and Albian carbonates, and the Pre-Salt play.

In shallow water there is potential for oil and gas discoveries in smaller turbiditic reservoirs, as well as significant potential for discoveries in the Albian carbonates, both within the Pos-salt play.

In the ultradeep, there is potential for discoveries in the Aptian carbonates within the Pre-salt play.

There are 15 blocks available in the Open Acreage under the Concession Regime. Also, there is an additional stock of 50 blocks for future inclusion in the Open Acreage.

Investment opportunities within the Pre-salt polygon are classified as Open Acreage under Production Sharing and are presented in a dedicated section on this webpage, providing detailed information on each area.

- Campos Basin

- Santos Basin

The Santos Basin, the most productive in Brazil, is known for its significant oil and gas production, primarily from the Pre-Salt play. Additionally, it has historical production from Post-salt sandstone turbidites and Albian carbonates.

There is potential for oil and gas discoveries in turbiditic reservoirs, as well as significant potential in the Albian carbonates, exemplified by the Caravela field. In this context, there is potential for medium-sized volume discoveries, like the Baúna field. These resources are part of the Post-salt play.

In contrast, the ultradeep water presents a distinct exploratory context, focusing on Pre-salt carbonate targets.

There are 149 blocks available in the Open Acreage. Also, there is an additional stock of 323 blocks for future inclusion in the Open Acreage.

Investment opportunities within the Pre-salt polygon are classified as Open Acreage under Production Sharing and are presented in a dedicated section on this webpage, providing detailed information on each area. - Pelotas Basin

Situated in the southern frontier of Brazil, the Pelotas Basin is a new and promising frontier basin that still carries a high exploration risk. However, there are indications of an active petroleum system, including source rocks and hydrocarbon shows, as well as potential reservoirs identified in seismic lines.

The basin offers opportunities for discoveries in Upper Cretaceous turbidite sandstone reservoirs, primarily in stratigraphic traps in the southern region, and Albian carbonate reservoirs, predominantly in the northern region.

Seismic data analysis reveals the presence of Direct Indicators of Hydrocarbons (DHI), such as Flat Spots, Bright Spots, and Gas Chimneys, which sometimes occur together associated with potential hydrocarbon reservoirs.

Due to the relatively unstructured characteristics of the Pelotas Basin, it is of utmost importance to focus on the reservoirs located near the Cenomanian-Turonian marine source rock. Surprisingly, these exploratory targets remain mostly untested in the deep waters of the Pelotas Basin thus far.

There is a stock of 309 blocks in this basin for future inclusion in the Open Acreage.

-

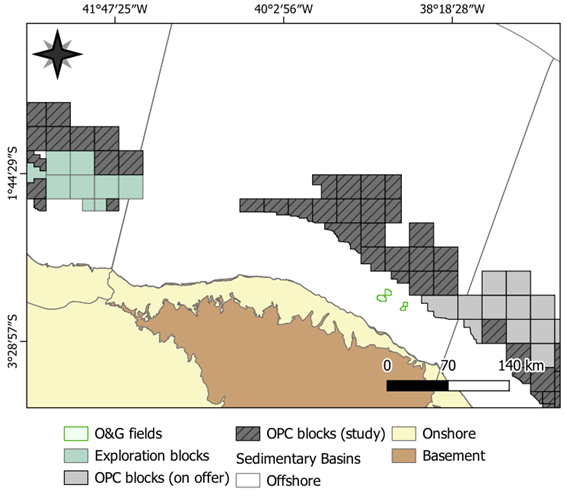

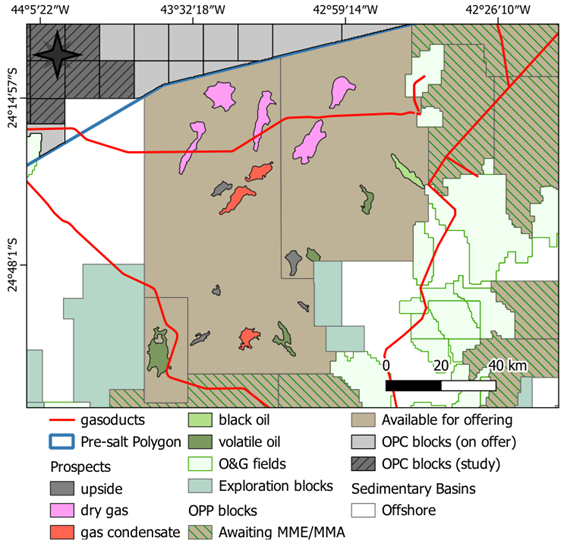

- Pre-Salt Polygon

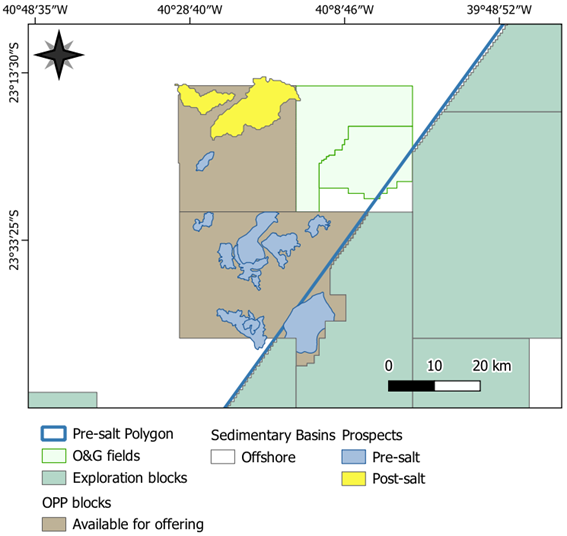

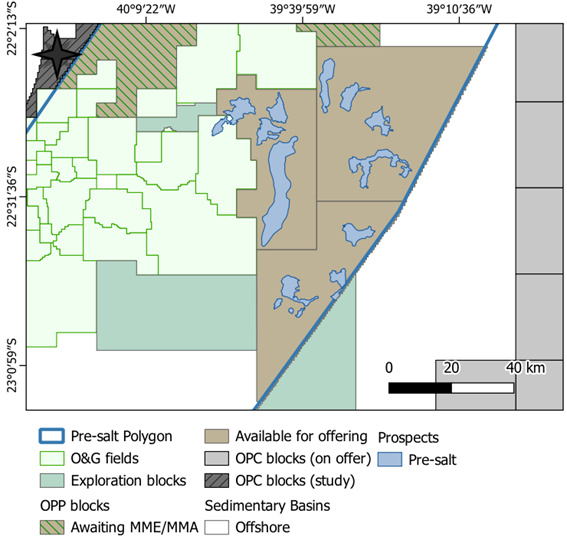

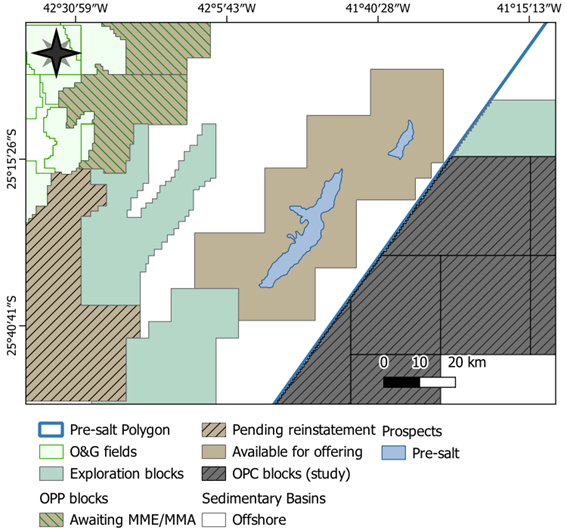

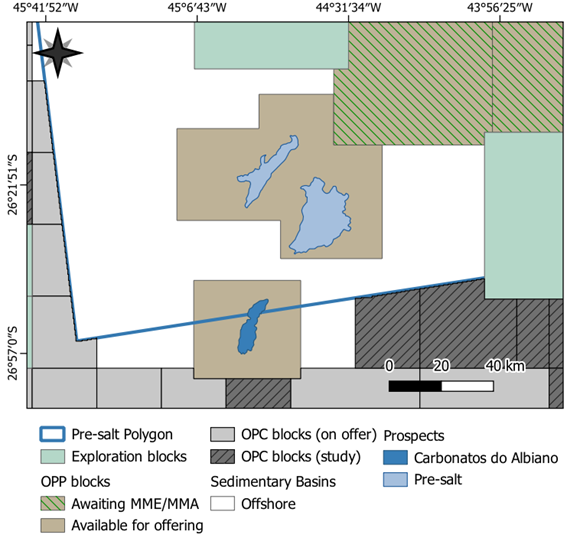

As of September 2025, 13 exploration blocks are available through the Open Acreage of Production Sharing (OPP), of which 7 are being offered in the ongoing 3rd cycle of OPP.

Additionally, the following blocks have been authorized for future inclusion in the OPP under CNPE Resolutions nº 26/2021, nº 11/2023, nº 7/2024, nº 16/2024 and nº 03/2025:

- Aragonita (Aragonite)

- Calcedônia (Chalcedony)

- Cerussita (Cerussite)

- Cruzeiro do Sul (Southern Cross)

- Granada (Garnet)

- Malaquita (Malachite)

- Mogno (Mahogany)

- Opala (Opal)

- Quartzo (Quartz)

- Rodocrosita (Rhodochrosite)

- Rubi (Ruby)

- Siderita (Siderite)

- Magnetita (Magnetite)

- Hematita (Hematite)

- Limonita (Limonite)

The Cruzeiro do Sul (Southern Cross) and Mogno (Mahogany) blocks have already received a Joint Statement by MME/MMA for inclusion in OPP. The other blocks are awaiting the issuance of the Joint Statement.

The Cruzeiro do Sul (Southern Cross) block is pending reinstatement in the OPP. As for the Mogno (Mahogany) Block, it has distinct contractual characteristics compared to the others, as part of its structures are located beyond the limit of the Exclusive Economic Zone.- Blocks on Campos Basin

-

In the current tender protocol of the OPP, six blocks are on offer in the Campos Basin: Citrino (Citrine), Itaimbezinho, Jaspe (Jasper), Larimar (Larimar), Onix (Onyx) and Turmalina (Tourmaline).

The primary exploration target is the pre-salt, except for Itaimbezinho, where the main target is on the post-salt.

- Turmalina Block

The Turmalina (Tourmaline) Block is in the northeastern region of the Campos Basin, east of the Roncador and Albacora Leste fields, within a water depth range of approximately 2,000 to 2,500 meters.

Within this block, five prospects have been identified in the Pre-salt play, including a larger one named Turmalina and four upsides. All structures have four-way closures and are situated between a regional high to the west and a regional low to the east. The unrisked mean volume of oil initially in place (VOIP) for the Turmalina prospect was estimated at 2.26 billion barrels, and the sum of the unrisked mean VOIP for the upsides was estimated at 1.36 billion barrels.

- Turmalina Block

- Jaspe and Itaimbezinho Blocks

The Jaspe Block features a main structure called Jaspe 1 in the Pre-salt, along with several upsides in the Coqueiros and Macabu formations within the same play. In this case, the primary fluid modeled for the structures was gas condensate. The estimated average unrisked hydrocarbon in place volume for Jaspe 1 is 875 million barrels of oil equivalent (BOE). The total estimated unrisked average volume for the block, considering the upsides, is 2.36 billion BOE.

The Itaimbezinho block's main targets are post-salt sandstone channels, with a smaller upside in the pre-salt. The total estimated unrisked average volume for the block is 2.04 billion BOE.

- Jaspe and Itaimbezinho Blocks

- Citrino, Ônix e Larimar Blocks

The Citrino (Citrine), Ônix (Onyx), and Larimar blocks are in the northeastern part of the Campos Basin, east of the Albacora, Marlim Leste, and Marlim Sul fields, in water depths ranging from approximately 1,000 to 2,750 meters. In the Citrino Block, oil has been considered as the main fluid. The block features a larger prospect in the Pre-salt and six upsides, with an estimated average unrisked volume of 3.56 billion barrels of oil in place.

For the Larimar and Ônix blocks, gas condensates have been modeled as the main fluid in place. Both blocks have a main prospect and several upsides in the Pre-salt. The estimated average unrisked volume of oil equivalent for the Larimar Block is 1.79 billion barrels. For the Ônix Block, the estimate is 1.46 billion barrels of oil equivalent.

- Citrino, Ônix e Larimar Blocks

-

- Blocks at Santos Basin

-

In the current tender protocol of the OPP, seven blocks are on offer in the Santos Basin.

The Ágata (Agate), Amazonita (Amazonite), Esmeralda (Emerald), Jade (Jade), Safira Leste (East Sapphire) and Safira Oeste (West Sapphire) blocks are currently being offered in the OPP, all with identified pre-salt structures. The Ametista (Amethyst) block stands out from the others due to its main structure likely being composed of albian carbonate reservoirs in the post-salt. - Jade Block

The Jade block is in the Santos Basin, approximately 150 km offshore, with water depths ranging from 2,000 to 2,500 meters. The main exploration targets in the block are the Pre-salt carbonate reservoirs, located in structural highs with four-way closure, roughly aligned in the N-S direction. This configuration is associated with a system of rotated half-grabens, where the main faults predominantly dip to the east.

The block contains a primary prospect in the Pre-salt called Jade, with an estimated volume of 2.91 billion barrels of oil in place. Additionally, six upsides have been identified around this structure, two of medium size and the others of small size, all within the same play. The total estimated volume for the upsides is 4.2 billion barrels of oil in place.

- Jade Block

- Ágata Block

The Ágata (Agathe) Block is in the Santos Basin, at an average water depth of approximately 2,500 meters, about 250 km off the coast. In this block, a main prospect in the Pre-salt called Ágata has been identified, with an estimated unrisked average of 2.82 billion barrels of oil in place. Additionally, to the north of the main structure, there is an upside also in the Pre-salt with an estimated unrisked average of 370 million barrels of oil in place.

The main structure is situated on a structural high of the basement and is bounded by geological NE-SW faults, following the same structural trend as the Pau Brasil (Brazilwood) block.

- Ágata Block

- Esmeralda and Ametista Blocks

The Esmeralda (Emerald) Block is in the Santos Basin, in water depths ranging from 2,000 to 2,500 meters, approximately 250 km off the coast. Within this block, two prospects have been identified in the Pre-salt play, named Esmeralda (Emerald) and Tupã.

The Esmeralda prospect exhibits well-defined four-way closure and is bounded by a major SW-NE-oriented normal fault dipping to the SE. The estimated average unrisked volume of oil in place (OOIP) for this prospect is 1.93 billion barrels.

The Tupã prospect is situated in one of the highest areas of the Outer High of the Santos Basin. It is a structural closure is conditioned by regional geological faults pinching out against the basement. The estimated average unrisked OOIP for this prospect is 3.95 billion barrels.

Despite the uncertainties in this area, well 1-BRSA-757B-SPS, drilled down-dip of the Esmeralda structure flank, revealed indications of good-quality oil in fine calcarenite reservoirs from the Albian section.The Ametista (Amethyst) Block is in the southern part of the Santos Basin, near the Aram and Esmeralda (Emerald) blocks. It has an average water depth of 2,500 meters. The block has been fully imaged using recently acquired 3D seismic data by TGS in 2021. Its main structure, also called Ametista (Amethyst), is characterized by probable Albian carbonate reservoirs, in the Post-salt, over a volcanic high. The estimated average unrisked original in place volume (OOIP) for the Ametista prospect is 2.7 billion barrels.

- Esmeralda and Ametista Blocks

- Amazonita, Safira Leste and Safira Oeste Blocks

The Safira Leste (East Sapphire) and Safira Oeste (West Sapphire) differ from the others as many pre-salt structures are prospective for natural gas or gas condensate, while others hold black or volatile oil potential. The estimated mean unrisked in-place volume is 4.9 billion BOE for the Safira Leste (East Sapphire) and 7.2 billion BOE for the Safira Oeste (West Sapphire).

The Amazonita (Amazonite) the main pre-salt structure has been modeled as a volatile oil prospect, with an estimated mean unrisked in-place of 4.6 billion BOE.

A key advantage of these blocks is their access to existing infrastructure, including gas pipelines crossing the area.

- Amazonita, Safira Leste and Safira Oeste Blocks

-

- E&P Strategic Goals and Measures

- Putting the right assets in the right hands: Petrobras’s Divestment Plan is central to this goal, as it allows, for example, the transfer of mature fields to small and mid-sized operators. ANP has also introduced a set of measures designed to support these companies, as explained below.

- Boosting the recovery factor: Brazil’s current recovery factor is only about 10%, which highlights the substantial untapped potential in mature fields.

- Expanding exploratory activities: The pandemic accelerated global energy transition debates and reinforced the urgency of intensifying exploration of Brazil’s oil and gas resources.

- Making marginal discoveries viable: Many discoveries in different environments remain undeveloped, but could become viable if the right incentives are applied.

To reach these goals, we must continue strengthening above-ground competitiveness.

Measures to Stimulate the Sector

- Exploration and production form the foundation of the oil industry: Significant resources are invested in technological development, the expansion of geological knowledge, and the creation of a supply chain that supports these activities. Exploration of awarded fields contributes directly to advancing geological knowledge of Brazil’s sedimentary basins.

- A more diverse sector has emerged from Petrobras’s Divestment Plan: Onshore and shallow-water fields are being are under cession, along with several large offshore Post-Salt concessions.

- Investments in mature fields, Pre-Salt developments, and offshore blocks in the exploration phase: Brazil is well-positioned to expand production and take a leading position in the sector.

- The oil and gas industry is undergoing an unprecedented transformation: Brazil continues to make progress in opening the market. See below the measures already implemented to encourage exploration and production activities.

Incentives for Mature Fields and Small and Medium-Sized Companies

- Royalties reduction: In 2021, ANP approved a royalties reduction for small and medium-sized companies. Earlier, a reduction mechanism for incremental production had already been established. Under this procedure, at the operator’s request, and once economic efficiency is demonstrated, royalties may be reduced to as low as 5% on incremental production from mature fields.

- Mandatory investment or Mergers and Acquisitions (M&A) in onshore and shallow water fields: In 2018, ANP set a deadline for Petrobras to divest fields where it had not been investing in recent years. The objective was to ensure the continuity of operations and maximize the recovery factor. As a result, several fields have already been transferred to small and medium-sized companies.

- Marginal field definition: Specific incentives are to be discussed at a later stage.

- Extending the production phase of contracts for oil and natural gas producing fields: The ANP approved Normative Instruction (IN) No. 11/2022, which sets guidelines for evaluating requests to extend the production phase of these contracts. The analysis of development plans with requests for contract extension must follow the IN guidelines. It should prioritize continuity of production in line with industry best practices. It should also require firm short-term investments aimed at maximizing reservoir recovery. The objective is to guarantee the highest possible return to Brazilian society.

Local Content

- Simplified rules for local content requirements.

- Lower obligations and more flexible compliance procedures.

- Companies may amend older contracts to adjust local content percentages to new rules.

- Companies may replace fines for non-compliance with new investments in goods and services in Brazil.

- Regulation of local content waivers defines criteria, requirements, and procedures for granting exemptions from compliance with local content obligations.

Decommissioning

- Regulation of decommissioning guarantees sets procedures for presenting financial guarantees that secure resources for decommissioning production facilities in oil and natural gas fields.

- Regulation of decommissioning defines rules and procedures for decommissioning exploration and production facilities, re-bidding contracted areas, disposing or reverting assets, meeting remaining obligations, returning the area, and additional measures.

Other Measures

- Reserve-Based Lending (RBL) and Mergers and Acquisitions (M&A) made easier: Regulation covers the assignment of contracts for oil and natural gas exploration and production, the constitution of guarantees on rights arising from these contracts, changes in corporate control of concessionaires or contractors, and other measures.

- Exploratory phase extension: Companies may sign amendments to concession contracts, giving them more time to make the necessary investments in exploration blocks.

- Repetro extension: The Special Customs Regime for the Oil and Gas Industry (Repetro) allows the importation of specific equipment for oil and natural gas exploration and production, without federal taxes or Merchant Navy fees.

- Free digital technical data: Public data on onshore sedimentary basins and offshore wells is available to companies at no cost (https://reate.cprm.gov.br/anp/).

- Natural Gas opportunities

- The New Gas Law, published in 2021, is a decisive step toward an open, liquid, and competitive market.

- A robust regulatory agenda is underway to build the new natural gas market, creating major opportunities in Brazil.

- Efforts are focused on monetizing the huge gas potential in the Pre-Salt.

- Most onshore exploration in new frontier basins targets gas production, and there are important reservoir-to-wire projects in the Parnaíba and Amazonas Basins.

- Downstream opportunities

- Brazil is one of the most attractive emerging markets for renewable energy investments: It is the second largest producer and consumer of biofuels. About 30% of the vehicle fleet is powered by renewable energy, while 70% to 80% of cars are flex-fuel.

- RenovaBio Program: In 2020, more than 14 million tons of greenhouse gas emissions were avoided thanks to the RenovaBio program, which aims to expand the production of biofuels in Brazil.

- Combustível do Futuro Program: This government program, called "Fuels of the Future", promotes large-scale use of second-generation ethanol, research and development in fuel cell technology, green corridors for heavy vehicles powered by biomethane, and the introduction of BioJetFuel, BioCCS, and other technologies.